To add geopolitics to international finance, let us do another example – that of the 2008 stock market crash and a financial upheaval. This whole thing was planned nearly 8 years earlier, precisely in September 2000. The background has to do with Iraq! Let us begin.

Currency Wars

Historically, a currency war involves competitive devaluations by countries seeking to lower their cost structures, increase exports, create jobs and give their economies a boost at the expense of trading partners. This is not the only possible course for a currency war. There is a far more insidious scenario in which currencies are used as weapons to cause economic harm to rivals. The mere threat of harm can be enough to force concessions by rivals in the geopolitical battle space.

These attacks involve not only states but also terrorists, organized crime, and other bad actors, using sovereign wealth funds, Special Forces, intelligence assets, cyber-attacks, sabotage and covert action.

The value of a nation’s currency is its weak point. If the currency collapses, everything else goes with it.

While markets today are linked through complex trading strategies, most still remain discrete to some extent. The stock market can crash, yet the bond market might rally at the same time. The bond market may crash due to rising interest rates, yet other markets in commodities, including gold and oil, might rise to new highs as a result.

There is always a way to make money in one market while another market is collapsing. However, stocks, bonds, commodities, derivatives, and other investments are all priced in a nation’s currency. If you destroy the currency, you destroy all markets and the nation. That is why the currency itself is the ultimate target in any financial war.

The 2003 Iraq War

After Iraq was defeated in the 2nd Gulf War (1991), sanctions were placed on Iraq. The war took place because Saddam Hussein refused to agree for its oil industry to be dominated by American-principally Rockefeller- oil companies.

At the end of 1999, a new currency came into being-the Euro. This was a Rothschild initiative designed to consolidate financial control of the EU, in addition, to make the Euro a global currency. This was not to the liking of the Rockefellers.

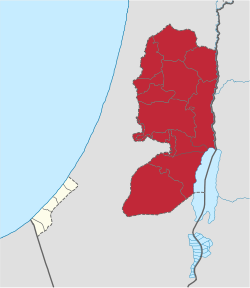

Here, we now see the cunning of the Rothschilds. From Israel’s geopolitical perspective, Israel was surrounded by Arabs who wished the removal of this occupation force amongst their lands. Israel has managed to neutralize Egypt, the largest Arab neighbor. Jordan was no problem. But Syria would always remain a threat. An even bigger threat was Iraq. The 8-year long Iraq-Iran War reduced Iraq’s military threat to Israel. But, Israel’s aim was to remove this threat from Iraq, once and for all, and the aim was to split it into three components. But, how to go about it.

With the introduction of the Euro, someone whispered in Saddam’s ears that: “Why do you want to deal in the enemy currency. As you recall, France and Germany have always been helpful to Iraq, in the past. So, why don’t you switch your oil sales into the Euro? In that way, you will stick it to the Americans, plus, we in Europe will be able to help you far more than the Americans ever will”.

Saddam Hussein fell for the trap. Emerging from a cabinet meeting on the 14th of September, 2000, Saddam Hussein announced that Iraq’s oil sales would now be denominated in euros. Little realizing it, this was his death warrant. No way will David Rockefeller allow the oil sales to move away from the dollar. This was a threat to the Rockefeller Empire, and to the hegemony of the dollar.

Within 30 months, the West invaded Iraq, and by the end of June 2003, Iraq was back to selling its oil for dollars. And within 2 years, Saddam Hussein was hanged. This would serve as a lesson to any other oil exporters contemplating such a move.

The Rothschilds achieved their aim regarding Iraq. But, this entire move angered David Rockefeller to no end. He counter-attacked. In September 2000, Iraq made the announcement of his move to the euro. In October, a key Rothschild bank on Wall Street-JP Morgan went bankrupt. This was a result of derivatives deals that resulted in massive losses that resulted in JP Morgan going bust. The Rockefeller bank Chase Manhattan took it over. The real treasure of JP Morgan was its ownership of 17% of the US Federal Reserve Bank.

At the time of its founding in 1913, the Rothschilds owned two thirds, and the Rockefellers owned a third. By taking over JP Morgan, it also took over this share of the Fed. This now gave the Rockefellers a MAJORITY share of the Fed.

With this now in place, the Rockefeller Network began its plan to cripple the euro. Starting in 2002, the emphasis by Wall Street was in promoting mortgage-backed securities, and sold the bulk of this to many banks globally. The European banks were amongst the biggest buyers of these derivative products. The Rockefellers pulled the plug in September/October 2008. The ensuing chaos crippled the European financial system. And this was the first payback, in a series of paybacks over the next 14 years.

This was a classic case of financial war. On the surface, it looks like the Anglo-American alliance is strong. From this, it is clear that there’s no unity amongst these power overlords. They act together in many areas, but also have a strong rivalry amongst them as well. Between the development of derivatives and currency wars, and its uses in the geopolitical arena, in the fight to dominate the globe, we have begun a descent into the maelstrom. The nexus of unrestrained global finance and unstable geopolitics is a beast that has begun to show its claws.

US foreign policy has always worked for its benefits. With economic collapse around the corner, in an age of austerity for the West, the US will dump its western allies.

How to Take Down an Economic & Geopolitical Rival – The Case of Germany

The formation of NATO was meant to “keep Germans down, the Russians out and the Americans in”. This has worked very well for Washington. From the 1970s to the late 2010s, Germany’s impulse to attain energy security and supply has been torpedoed many times by Washington. More details on these can be found in our article , titled “The Geopolitics of Germany “, due out in a few months, God Willing. The latest move was Germany refusing to certify the Nordstream 2 pipeline, under pressure from Washington.

Around the year 2005, the Rockefeller Empire began to extract oil and gas from shale oil formations. Infrastructure was built to export this increasing volume of natural gas, such as LNG export terminals. At the same time, the gas market was stable due to long-term supply and price agreements, and most of this was via pipeline gas. The US could not build a pipeline for gas to the EU, thus, it has opted to boost the global LNG market. To make sure of this, Wall Street began to work on moving the gas business from a stable long-term supply to the spot market, just as Wall Street achieved with oil back in the mid-1980s. In short, pricing power has shifted from OPEC to the spot markets- which can be easily manipulated.

On August 31st, the exchange-traded market price for natural gas in the German THE (Trading Hub Europe) gas hub was trading more than 1300% higher than a year ago. Politicians say that the reason is Putin and Russia’s war in Ukraine. The truth is quite otherwise. EU politicians and major financial interests are using Russia to cover for what is a Made in Germany and Brussels energy crisis. The consequences are not accidental.

It is all part of the EU plans to deindustrialize one of the most energy-efficient industrial concentrations on the planet. This is the UN Green Agenda 2030 otherwise known as Great Reset. For almost two decades the EU Commission, backed by Rockefellers’ JP Morgan Chase, began to lay the basis for what is today a complete deregulation of the market for natural gas. It was promoted as the “liberalization” of the European Union’s natural gas market. What it now allows is for unregulated real-time free market trading to fix prices rather than long-term contracts. Beginning around 2010 the EU began to push a radical change in rules for pricing natural gas. Prior to that point most gas prices were set in fixed long-term contracts for pipeline delivery. The largest supplier, Russia’s Gazprom, provided gas to the EU, most especially to Germany, in long-term contracts pegged to the price of oil. Until the last several years almost no gas was imported by LNG ships. With a change in US laws to allow export of LNG from the huge shale gas production in 2016 US gas producers began a major expansion of LNG export terminal construction.

Since the 1980s Wall Street banks, led by Goldman Sachs, created a new market in “paper oil,” or futures and derivative trading of future oil barrels. It created a huge casino of speculative profits that was controlled by a handful of giant banks in New York and the City of London. The Rockefeller Empire have been working for years to create a similar globalized “paper gas” market in futures they could control. The EU Commission and their Green Deal agenda to “decarbonize” the economy by 2050, eliminating oil, gas and coal fuels, provided the ideal trap that has led to the explosive spike in EU gas prices since 2021. To create that “single” market control, the EU was lobbied by the globalist interests to impose draconian and de facto illegal rule changes on Gazprom to force the Russian owner of various gas distribution pipeline networks in the EU to open them to competitor gas.

The big banks and energy interests that control EU policy in Brussels had created a new independent price system parallel to the long-term, stable prices of Russian pipeline gas which they did not control.

By 2019 the series of bureaucratic energy directives of the Brussels EU Commission allowed fully deregulated gas market trading to de facto set the prices for natural gas in the EU, despite the fact that Russia was still by far the largest gas import source. A series of virtual trading “hubs” had been established to trade gas futures contracts in several EU countries. By 2020 the Dutch TTF (Title Transfer Facility) was the dominant trading center for EU gas, the so-called EU gas benchmark. Notably, TTF is a virtual platform of trades in futures gas contracts between in trades between banks and other financial investors, “Over-The-Counter.” That means it is de facto unregulated, outside any regulated exchange. This is critical to understand the game being run in the EU today.

In 2021 only 20% of all natural gas imports to the EU were LNG gas, whose prices were largely determined by futures trades in the TTF hub, the EU de facto gas benchmark, owned by the Dutch Government, the same government destroying its farms for a fraudulent nitrogen pollution claim. The largest import share of European gas came from Russia’s Gazprom supplying more than 40% of EU imports in 2021. That gas was via long term pipeline contracts whose price was vastly lower than today’s TTF speculation price. In 2021 EU states paid an estimated EXTRA cost around $30 billion more for natural gas in 2021 than if they had stuck with Gazprom oil-indexation pricing. The banks loved it. Only by destroying the Russian gas market in the EU could financial interests and the Green Deal advocates create their LNG market control. With full EU backing for the new gas wholesale market, Brussels, Germany and NATO began systematically to close stable, long-term pipeline gas to the EU.

After she broke diplomatic ties with Morocco in August, 2021 over disputed territories, Algeria announced the Maghreb-Europe (MGE) gas pipeline, which was launched in 1996, would cease operation on October 31, 2021, when the relevant agreement expired.

By systematically sanctioning or closing gas deliveries from long-term, low cost pipelines to the EU, gas speculators via the Dutch TTP have been able to use every hiccup or energy shock in the world, whether a record drought in China or the conflict in Ukraine, to export restrictions in the USA, to bid the EU wholesale gas prices through all bounds. As of mid-August the futures price at TTP was 1,300% higher than a year ago and rising daily.

The deliberate energy and electricity price sabotage gets even more absurd. In every respect the suicidal energy crisis ongoing in Europe has been “Made in Germany,” not in Russia. And behind the German Green Party stands the Rockefeller Empire.

Today the United States, is desperately seeking to maintain its leadership through destructive actions against not only its adversaries, but also allies in all directions.

Although the declared American foreign policy strategy officially names only Russia and China as adversaries, the EU is included in this list as well.

As it avoids openly undermining the European Union, Washington has been doing its utmost in recent years to not only stealthily govern it, but also to contribute to its disintegration. It is doing everything possible not only to avoid losing Europe, but also to eliminate the EU as a potential rival in the dispute over geopolitical influence. In this regard, the placement of Washington-trained personnel such as Ursula von der Leyen, Charles Michel and Josep Borrell in leading positions in the EU states and in its governing bodies has become an important tool in subjugating the EU. The above politicians have long been guided in their actions only by instructions from the United States, with complete disregard for the interests of the whole Europe and their native countries in particular. To weaken the economic competitiveness of a united Europe, Washington has devised a multi-pronged operation to weaken European energy security. Ultimately, Washington succeeded in convincing a significant number of EU countries to tighten sanctions against Russia, limiting Russian energy supplies to the European market, without which the EU would collapse economically and energy-wise, despite all this going blatantly against Europe’s own interests.

Wall Street also aims to take over the export markets of European, principally German, economies. In addition, the major banks within the EU will collapse. The result was galloping inflation in Europe and the closure and bankruptcy of many European companies, especially those oriented towards the Russian market. The economic and energy crisis in Europe is steadily increasing the protest movement in the EU countries, destabilizing the political and social situation there and thus further reducing its competitiveness with the US, which is precisely what Washington wanted.

In order to further damage Europe, Washington, with the help of Poland began to heat up the financial and territorial claims between the EU member states, thus deepening the division in the union. As a result, following demands for reparations from Germany for the consequences of World War II, the Polish government will soon be filing claims against the Czech Republic.

And this is clearly not the limit of Washington’s treacherous plans to break up the European Union and win the competition with the Old World for world domination. Ultimately, the tool of biological warfare, as exemplified by the Covid pandemic, has already been tried by the United States and it has not only brought massive misery to Europe, significant financial and human losses, and then enriched the same US pharmaceutical companies. To further compound the financial solvency of both British and European governments, many are now “subsidizing” the energy bills of households, in order to stave off social unrest. These governments were already heavily in debt when they gave billions to their citizens, and even more billions funding Covid vaccinations, etc. In this dire state, they are now going even further into debt. This is not even mentioning the massive loan losses of Europe’s largest banks- most of whom were insolvent even before Covid. With ECB head Christine Lagarde insists that the Central Bank will not bail out companies, but that governments must do it, the British led the way when the Liz Truss government announced a $140 billion household energy aid plus corporate bailouts of $50 billion, plus additional subsidisers for the prices of energy. Due to sterling’s lower exchange value, the total bailout amounts will be much bigger. The same applies for most EU countries.

The German government has created an emergency intervention fund of $6 billion to support energy-intensive companies to prevent their collapse. As of writing, Berlin is close to nationalize Germany’s largest gas importer Uniper (at a cost of $15 billion as of writing). So far, 3,200 requests for such support have been registered at the fund, but there are many more to come. As the bigger companies’ bills range in the millions of euros, not that much money will be left to support the 1000s of medium size companies. A wave of production stops at companies, with the related layoffs, is there preprogrammed. That said fund has so far only approved 24 of the 3,200 requests. Keep in mind that many companies have still not received the support promised to them during the past two years of the Covid pandemic.

All of these factors combined will result in the de-industrialization of Europe, resulting in the elimination of the EU’s geopolitical weight in international affairs. Europe as a whole will be relegated to irrelevance. It’s “bye-bye, Europe!’

And finally, the great social disruption in Germany will lead to an emigration of skilled labor from Germany to the US. As Germany goes, so does the rest of the EU. This “brain drain” will harm Germany even more, and will help boost the skilled resource base of the US, not to mention the increase in the US population base.

All of the above fits in very well with the Rockefeller family motto:” COMPETITION IS A SIN!” Let me give you a few more recent examples, below.

The Great Robbery & Competition (to the $) is a Sin

In September 2000, Saddam Hussein of Iraq issued a decree that Iraq’s sale of oil would be done in euros, and not the dollar. In March 2003, the US invaded Iraq, toppled Saddam Hussein, and brought the sale of Iraq’s oil back into dollars.

Many have criticized Washington for staging the war in Iraq to seize the oil fields. It made no sense to seize the oil fields as Washington could just print more dollars to buy Iraq’s oil. Benefits from the sale of Iraq’s oil were not worth the multi-trillion cost of that war. Instead, it was to defend the petro-dollar standard. No longer could the world buy oil from Iraq using the euro. Global dollar supremacy was once again restored. The Rockefeller Empire had given a job to Washington. Bring Iraq back onto the petro-dollar standard. In May, 2003, President Bush declared the mission “accomplished” – he had successfully defended the petro-dollar, and thus the American Empire of the Rockefeller family.

In 2009, Libya’s leader, Muammar Ghaddafi proposed the sale of his country’s oil for gold dinars. Two years later, he was toppled, and murdered, just like Saddam Hussein.

In 2004, Iran began preparing an oil exchange, or bourse, that would trade oil for euros. And problems began immediately for Iran. Originally scheduled to open in 2004, the date was postponed several times, until March 2006. The exchange was built on Kish Island, just off Iran’s coast. It was at this time that New York began to highlight Iran’s’ nuclear program, saying it constituted a threat to the region, and the world. This was an attempt to hold back Iran’s plans for this oil bourse to begin functioning. It was a threat from America to Iran. “If you start your oil trading in Euros, then we are going to bomb you.

From attempts at regime change, to internal destabilizations, to sanctions, anything was possible. And Washington has tried them all. When all else fails, then war is clearly the second-best available option.

In order to better understand current financial movements and directions, let us go back 40 years to explain the dollarization of the global economy, and how this has benefited only one group of financiers – the Rockefeller family, as the overlords of the American Empire.

The petro-dollar was born in 1975. That same year saw the first challenge to the petro-dollar. This came from Iran, in league with France, Germany, and South Africa. It took Washington 4 years to neutralize this threat. Once this victory was achieved, in 1979, David Rockefeller placed his employee, Paul Volcker, as the head of the Federal Reserve. Volcker tripled interest rates to 20%. Tens of billions of dollars flowed into New York, as a result. And this story of a constant move of drawing in dollars from the rest of the world, into the American banking system, is what I call “vacuuming” the globe of dollars. Time and again, this aspect of financial warfare has been utilized to devastating effect on the global economy, all to benefit a handful of individuals, and institutions i.e. to benefit the American Empire.

The Wall Street “Vacuum Machine”

Wall Street has a periodic bout of hunger – hunger for more dollars to maintain its faltering dollar empire. The heart of this dollar empire is Wall Street, New York City. The developing economies were hit badly after the 1973 oil shock. Prior to this, their export of commodities and raw materials were growing – mainly to Europe and Japan. The 1973 oil shock, followed by the 2nd oil shock in 1979, completely derailed any growth prospects for the Third World economies.

Firstly, the price of their exports dropped. Secondly, they now had to borrow from the banks in London and New York, in order to pay for oil imports – the price of which had gone up by 9 times, over 6 years. And thirdly, the cost of servicing their loans tripled.

The 1st case: – The result was a wealth transfer from the developing economies to London and New York. Around $400 billion made its way to New York, from Africa, Asia, and Latin America. These funds went to boost up the New York stock markets. Funds that were meant to develop the local economies went instead for speculation.

The 2nd case was when Rockefeller’s Chase Manhattan Bank froze, then later, confiscated some $12 billion belonging to Iran, in the wake of the Shah’s fall.

The 3rd case was Russia after the fall of the Soviet Union. Between 1991 and 2000, the economy of Russia went into a free fall. Between these years, around $300 to $500 billion was looted from the economy, through the exports of oil, metals, and other goods. In addition, the entire gold reserves, amounting to 2000 tons, of the Russian central bank went missing!

The 4th case is Kuwait. When Iraq invaded Kuwait in August 1990, the Kuwait leadership was told that they have to pay New York a ransom if they wanted their country back. At that time, Kuwait‘s sovereign wealth fund was housed in the Kuwait Investment Authority, the KIO. The reserves of the KIO stood at $175 billion in August 1990. A year later, the reserves stood at $50 billion. What happened to the other $125 billion? It went to the Rockefeller Empire – the controlling entity of the American Empire. A very small portion of this ransom went to a Saudi prince, Al Waleed, owner of Kingdom Holdings. Al Waleed and his father are the black sheep of the Saudi royal family. Al Waleed used this money to buy stakes in many Rockefeller companies, the most notable investment being in Citigroup – at that time bankrupt. In short, Al Waleed is a front man for Rockefeller interests.

The 5th case is Japan. In late 1991, Japan began to deflate. Billions left Japan for New York. A second attempt at controlling Japan’s financial system was tried by New York, in late 2010. When Tokyo refused to grant David Rockefeller control over its financial system, Japan was “harped”, in March 2011. A Tsunami hit Japan’s east coast. The country lost a fortune, in addition to suffering a nuclear catastrophe at Fukushima. Japan has still not recovered as of 2016.

The 6th case is the booming economies of south-east Asia. Thailand, Malaysia, Indonesia, Korea were the targets. They were first fed with huge amounts of offshore funds coming in to these economies. Then in 1997, the flow reversed. Around $100 to $300 billion made their way to New York, and these economies were devastated.

The 7th case was the American economy itself. Wall Street turned on its vacuum machine inwards. This was in March 2000, the date when the dotcom bubble burst. Between 1997 and end of 1999, the media was extolling the virtues of the internet economy. To give credence to this lie, all they had to do was point the finger at the booming stock market, especially those companies involved in this sector. They forgot to mention that the stock market was boosted by all these funds leaving Russia, and Japan, and the south East Asian economies. The American investing public lost a few hundred billion dollars in the bursting of the bubble, and so did millions of others throughout the world. Remember, money is a zero sum game. When someone loses money, it means that someone else has gained this money. And the ones that have gained this money is the Rockefeller financial institutions.

The 8th case took place in Argentina in 2000. Between November and December of 2000, all of Argentina’s foreign cash reserves were loaded flown out of the country very quietly. In January 2001, Argentina defaulted on its foreign loans. An amount of $30 billion in cash was smuggled out of the country, into the banks in New York and Miami. The middle class in Argentina became destitute overnight.

The 9th case was in Iraq. In late March 2003, the CIA electronically hacked into the Central Bank of Iraq, and stole $40 billion. This so shocked Saddam Hussein that the next day his two sons went into the Central Bank and removed all of Iraq’s official gold and foreign exchange cash, and hid it elsewhere.

The 10th case is in 2008, when the stock markets crashed. The blame was the sub-prime mortgage market. But from earlier notes, we know it was a controlled crash, engineered by the Rockefeller Empire to punish the euro, and the Rothschild financial empire. New York succeeded brilliantly.

This case is ongoing, at this very moment, and will be discussed in more detail in later issues. It is financial warfare at its best.

The 11th case is of Libya. When Libya was taken down by the West in 2011, its vast financial assets of more than $300 billion were stolen. Many banks in New York and London had Libyan investments. In addition, Libya owned stakes in a few European companies. These were also stolen. Libya’s gold vanished. Libya’s ruler Qaddafi had managed to send some cash and gold for safekeeping, in mid-2011, for safekeeping. Presently stored in a warehouse in Johannesburg, this stash amounts to more than $100 billion! Expect this to be sequestrated by New York shortly.

The 12th case was when Washington, in November 2018, by confiscated nearly $2 billion of Venezuela’s official gold stock held in London.

The 13th case is when $7 billion of Afghanistan’s gold and other reserves were simply taken by Washington, in August as the US fled from Afghanistan, in total humiliation.

The 14th case was when the Biden Administration made a much larger asset grab of some $300 billion of Russia’s foreign bank reserves and currency holdings in March 2022.

The 15th case is the theft of the gold in Europe, at the end of World War 2. This was gold that the Nazis looted during the course of the war. Estimates of this quantity of gold are between 10,000 to 20,000 tons. This gold was taken over by the US Army, and subsequently placed under the control of the Rockefellers. It was put into an informal trust called the Black Eagle Trust.

The 16th case is the theft of the gold and treasures looted by the Japanese between 1895 and 1945. The Japanese were unable to transfer all this loot back to Japan. Many hidden vaults were built in the Philippines to stash this gold, with the hope that this gold would help to revitalize the Japanese economy. But, the Americans found a lot of this loot and took it over. This was called Yamashita’s Gold. The quantity of this gold that was recovered amounts to between 500,000 to 2 million tons! https://behindthenews.co.za/yamashitas-gold-part-1-of-a-5-part-series/

When one adds these many cases of theft, we find that the U.S. itself is ending the Dollar Standard of international finance. The Trump Administration took a major step to drive countries out of the dollar orbit. It made official a radical new epoch in Dollar Diplomacy. Any nation that follows policies not deemed to be in the interests of the U.S. Government runs the risk of U.S. authorities confiscating its holdings of foreign reserves in U.S. banks or securities.

This was a red flag leading countries to fear denominating their trade, savings and foreign debt in dollars, and to avoid using dollar or euro bank deposits and securities as a means of payment. By prompting other countries to think about how to free themselves from the U.S.-centered world trade and monetary system that was established in 1945 with the IMF, World Bank and subsequently the World Trade Organization, the U.S. confiscations have accelerated the end of the U.S. Treasury-bill standard that has governed world finance since the United States went off gold in 1971.

What seems to be so self-destructive about America’s economic sanctions and confiscations of Russian and other foreign reserves is that they are accelerating the demise of this free ride. We have begun a descent into the maelstrom. The nexus of unrestrained global finance and unstable geopolitics is a beast that has begun to show its claws. Financial warfare threats can be grasped only in the context of today’s financial world. This world is conditioned by the triumph of globalization, the rise of state capitalism and the rise of terror. Financial warfare is one form of unrestricted warfare, the preferred method of those with inferior weapons but great cunning. Besides stealing the wealth of governments, the two families are now reduced to stealing from the clients of their own banks, which will now be explained below.

Bank Bail-Ins – Your life Savings Could be wiped out in a Massive Derivatives Collapse

In 2012-2013, the Cyrus banking system went bust. The European Central Bank, the ECB, just 4 years earlier, had bailed out the European banking system, with the help of the EU governments. By 2012, the EU Commission and EU governments were not in a position to bail out any more banks. And so a new type of ‘rescue’ was launched. This was the “bail-in” concept, instead of the “bail-out” of the past. The first casualty of this new policy occurred in Italy.

At the end of November 2015, an Italian pensioner hanged himself after his entire $160, 000 savings were confiscated in a bank “rescue” scheme. He left a suicide note blaming the bank, where he had been a customer for 50 years, and had invested in bank-issued bonds. The rescue was a “bail-in” – meaning bondholders suffered losses – unlike the hugely unpopular bank bailouts during the 2008 financial crisis, which cost ordinary EU taxpayers hundreds of billions of Euros. It is entirely possible in the next banking crisis that depositors in failing banks could have their money confiscated and turned into equity shares.

Once your money is deposited in the bank, it legally becomes the property of the bank. Your deposited cash is an unsecured obligation of your bank. It owes you that money back. If you bank with one of the biggest banks, who collectively have trillions of dollars of derivative bets they hold “off balance sheet”( meaning those debts are not recorded on the banks’ balance sheets), those debts have a superior legal standing to your deposits and get paid back before you get any of your cash.

The bail-in policy went into effect across the EU on Jan 1, 2016, and the same has been authorized in the US. Bail-in has been sold to the public as the way to make sure that another Lehman – style 2008 financial crisis never occurs. Instead of using governments’ funds to bail out failing banks through Quantitative Easing and other hyper inflationary measures, depositors and some investors will have to bail out the failing banks. This was done in Cyprus when its banks went belly-up in 2013.

One man’s bail in is another man’s bail out. And the financial instruments to be bailed out are derivatives. The plan, in other words, is to rob Peter (you and your family) to pay Paul (Wall Street and the City of London). Bail-in bonds are self-defined as bonds that would be instantly expropriated when a bank becomes insolvent – in other words, they are rat poison. Who in the world would ever buy such a guaranteed-to-fail financial instrument? In fact, no European banks were able to market any bonds whatsoever in the first 3 weeks of January!

To understand more of this, please go to the article called ICE NINE- How the Global Elites are planning to steal your money – dated Feb 10, 2018, https://behindthenews.co.za/ice-nine-how-the-elites-plan-to-steal-your-money-the-global-financial-lockdown/ . This was the end-game for the two families. And “move no 1”, on the chess board was Covid.

The Crash Begins

William White is a top financial economist working for the British financial elite. He is the head of the OECD’s review committee. This is what he had to say; “the macroeconomic ammunition to fight down-turns is all used up, and many of the debts that have built up over the past 8 years will never be repaid; low interest rates provided by central banks used to kick start recovery the last time around have fueled credit bubbles in East Asia and emerging markets – leading to both private and public debt reaching historic levels.

“Emerging markets were part of the solution after 2008. Now they are part of the problem, too.”

With central banks unable to lower interest rates much more, and with the economic slowdown in China, many economists fear it could be the start of a global financial meltdown. The entire trans-Atlantic financial crash is in full swing, and this collapse is gaining more and more momentum. Four hedge funds have already gone bust in the US because they were entangled in a $5 trillion derivatives bubble; they had concluded contracts when oil was at $80 a barrel while the price had fallen to $30.

Likewise the bubble in the commercial real estate market has now grown even larger than 2007.

Faced with indebtedness and derivatives exposures amounting to the trillions, Wall Street and London have only two cards up their sleeve: 1.-further money printing and 2- the theft of depositors’ funds, and expropriation of investors bonds and stockholders. This can only be described as criminal. The more this crash expands the more human lives it will cost. Under this new bail-in policy now being implemented , everything you and your family may have – savings, pensions, food, health care, jobs, homes, everything – will be seized in the name of protecting the criminal financial system which created that speculative bubble. This is what is predicted for 2022/3; massive sacrifice of savings and jobs to prop up a bankrupt global financial system.

The actual root of the problem is that people fell for the lie that money is actual wealth, and an entire financial system has been built on that lie. But, money is not something which has a self-evident value. Value depends upon the creative powers of mankind, to make better the conditions of life of mankind.

As the system is tearing apart, other countries may try to insulate themselves from this by embracing capital controls. The dollar has no peers. But the system that it anchors is cracking. Panic among Wall Street and City of London bankers is evident just barely below the surface.

When financial markets are crashing, wars inevitably follow. That is even more reason to keep a close eye on events in the Middle East. As the competing nations try to grab the energy resources of the area, all it would take is a spark to detonate World War Three!

In the next article, we will detail the key reasons why the dollar-based financial system is coming to an end. When this is unravelling, it has the potential to drag the entire global economy with it. To find out more, open up the next and last part to this article, https://behindthenews.co.za/the-end-of-dollar-hegemony-part-4-of-a-4-part-series/