The Start of Derivatives

More than other financial product, derivatives is responsible for the destruction of the Western banking system. Here, we will attempt to show you how this started, and its poisonous role in destroying the current western-styled banking system. Around the early 1980s, a currency swap deal was done between the World Bank and IBM. It went like this.

The World Bank used to borrow around $8 billion a year in various currencies to fund the banks’ lending program to developing countries, and was looking for the cheapest interest rates at which to borrow, in Swiss Francs and the German Mark. The World Bank did not want to borrow so much in these currencies, so as not to overload them. A Wall Street firm, Salomon Brothers had IBM as a client, which had large Swiss franc and German mark loans it no longer wanted, but could not get rid of them. So the World Bank took out a dollar loan and swapped it for IBM’s loans. IBM would pay the interest and principal on the dollar loan to the World Bank; the World Bank would pay the interest and principal on the Swiss franc and German mark loans to IBM. IBM got rid of its loans at a profit, while the World Bank got the foreign borrowing it wanted without upsetting the central banks of Switzerland and Germany.

Although it wasn’t the very first swap ever done, with two such blue chip names involved, the rest of the financial world sat up and took notice. From there the market took off like a ballistic missile. Soon after the World Bank-IBM deal, a few bankers realized that swaps could be a big, lucrative business – the biggest poker game in town. Desperate not to be left out, they took over the market within three years. At first they acted simply as marriage brokers, but they quickly saw that there was more money to be made by taking one side of the swap themselves. This was convenient for everyone, but it was also a heaven-sent opportunity for the commercial banks which were grappling with the awkward problem of having lost billions in loans to Latin America and the Third World. Bankers started to look elsewhere for more reliable borrowers. To add insult to injury, the central banks made the quest more urgent by tightening the rules governing bank safety. The banking authorities had been frightened by the way the Latin American debt crisis had seriously weakened the world banking system, and as financial markets rapidly internationalized, they also wanted a common set of rules to apply to all banks so that the whole industry would be playing the same game.

The new rules required banks to have a higher level of core capital to underpin their lending than before, which made life more difficult for them. To comply, they would either raise more capital or make fewer loans. Most did both. But the effect of putting aside more capital against fewer loans was to reduce their profit from lending. Clearly, to keep up their profitability they had to find new ways to make money.

Swaps were the answer to the industry’s players. Banks could earn handsome fees from selling swaps to exactly the same customers to whom they made loans – companies, other banks, governments – BUT THE SWAPS ARE NOT LOANS! If a bank did a $100 million swap with a company, it did not actually hand over $100 million. The counterparties simply exchanged their interest payments. Since a swap was not a loan, it did not count against a bank’s capital the way loans did. It was “off balance sheet”, and outside the new rules proposed by the central banks. A bank could theoretically do an unlimited number of swaps without ever worrying that it did not have enough capital.

At first Citibank did smallish swaps for huge fees. Then, as it usually does in banking, the sheep mentality took hold. The rest of the industry saw how much profit the pioneers were making and followed their lead. In the early days (1981/2), $50 million counts as a large interest rate swap but the fees were so large that the first banks into the business made money hand over fist. As the market quickly became an orgy of swapping with the banks at the center, the size of the deals escalated. By the mid-90s a swap of $1 billion hardly raised eyebrows and competition had driven the fees down to a fraction of what it once was. That is how swaps came to be the most popular financial instruments in the world. The amount of principle outstanding on all swaps in 1986 was around $150 billion. By 1995, it was around $30 TRILLION, making it easily the largest element of the derivatives market. By 2020, this market was closer to some $500 TRILLION!

New York and London share this massive business between them: New York for interest rate swaps, London for foreign exchange swaps because of its position as capital of the world’s currency markets.

An additional problem was that most traders still inhabited the technological Stone Age. Few people could do complex calculations in their heads, but there were no computer models or complex programs to carry out the increasingly tortuous calculations involved in swaps and other derivatives. The most sophisticated piece of equipment the traders had was a pocket calculator. By the mid-1980s, no self respecting derivatives quant, trader or salesman anywhere in the market could reasonably expect to stay in the game without a computer.

Structured Note

A structured note is a complex derivative instrument designed to do a specific job for a specific customer. Such instruments are the quintessential product of the derivatives market. And because they are not standardized they come in all shapes and sizes. Almost from the moment they came into existence, structured notes had a tendency to grow more complex, more elaborate and more pointless as time went on.

The trouble with “plain vanilla “derivatives such as ordinary interest rate swaps is that when every international banks in the world is doing them the profit margins become horribly thin. New instruments, on the other hand, always command a premium price. Banks began selling futures and options to their customers, then options on futures, options on swaps, swaps futures with options attached, and on and on. There seemed to be no limit to the number of products they could invent.

Creating a structured note was a matter of pure mathematics – formulas so long they covered 2 or 3 pages of A4 paper. The banks turned themselves into financial laboratories, conducting increasingly complex experiments with new forms of derivatives. The “rocket scientists”, or quants, pushed the mathematics of finance to greater and greater extremes of refinement. Like a lab full of mad biologists, the quants have spent the last 2 decades dissecting the markets with the scalpel of mathematics, isolating and extracting different risks, then analyzing them under the microscope to see what they contain. This is where the complexity of derivatives, which are practically “expression of risk” in the market, really begins. Once you have isolated a particular risk and found how to put a price on it you can package it and sell it individually. A “plain vanilla” exchange traded futures contract is like this. But the quants went further. Once they were able to take risks apart they could switch them around, mix-and-match them, and stick them back together again in completely new structures.

Let me simplify this point by an example:

Suppose a British investor expects the Japanese stock market to rise and the US stock market to fall, and wants to profit from the difference. Instead of doing a long and expensive series of separate stock, option and currency trades, a bank can now sell him a single derivative instrument containing a call option on the Tokyo stock market index , a put option on the New York index and a currency hedge that will protect his profit in sterling. The instrument links different assets and markets more closely than they have ever been linked before, yet the investor never has the expense and complication of having to buy actual shares in Japan or the US. What he has traded is the risk inherent in their movement.

There was nowhere in the structured note market that indulged in more spectacularly and unnecessary innovation, and which has caused more financial pain, than the US bond mortgage market. Banks collected mortgages and put them into a trust that paid out interest and principal derived from the mortgages. Investors could buy a slice of the trust, an entitlement to a share of these payments. Their share was called a Collateralized Mortgage Obligation, or CMO. But as more banks saw the profits and piled into the market to get a slice, the extra competition drove down the profit margins relentlessly. To keep the money rolling in, the banks simply accelerated the deal flow. But that meant finding new customers to whom to sell mortgage securities, which in turn spurred the quants to creating new instruments that would appeal to investors. The more complex the inventions of the rocket scientists, the more difficult it was to put a value to them. A particular bank may be the only institution in the world capable of unravelling a particular derivative because it was the one who created it in the first place. Among those who did not, and could not, understand it were most investors. They frequently had no clue as to the real value of what was being sold to them, which made it easy for the banks to impose high fees on their new instruments.

In 1994, the Fed raised interest rates, causing a massive implosion of the CMO market. Investors all over America could only stand and stare in bewilderment as instruments that they had thought were safe exploded before their eyes. Many of them should never have bought the CMO’s in the first place. They were the dumb guys the investment bankers had been searching for and had eventually found. They were mainly investment fund managers seeking ways to jack up their performance to the high levels they were used to in the 1980s, and this had given them an addiction to high-yielding bonds – or things that looked like high yielding bonds until market conditions changed and they detonated like hand grenades. Most of the time funds did not understand what they had bought. They didn’t have the expertise to do so, and the brokers- many of whom did not understand any better- did not explain. The wreckage was impressive.

The equation linking knowledge, power and profit has rarely been applied as ruthlessly as it has in the derivatives market and the banks used their power and knowledge to profit quite ruthlessly from their customers. It took the investors many months to realize that the banks were acting as predators and not advisors. This permanently damaged trust between the investors and banks.

The rocket scientists had truly made their mark. While there is no doubt that many investors were greedy and took foolish risks, it is also true that thanks to the new financial instruments being offered to them , they frequently did not understand the risks they were taking. Hardly anyone did (especially the banks senior management). Hundreds of companies that lost money from investing in complex derivatives found ingenious ways of disguising the fact in their accounts.

The Banks become their Own Customers

The barely contained chaos of banks derivatives operations is worrying because of the pivotal role banks play in the market. As they fastened on derivatives as an important new source of profits during the 80s and 90s, they became the biggest users in the world, transforming themselves from mere lenders into gamblers. Instead of advancing their capital for other people to use, they began using it themselves to place bets in the financial markets. Conservative, cautious banks were behaving more like high rollers at a casino. While heightening the danger of individual bank failures, this has also increased the fragility of the banking systems, undermining its resistance to unexpected shocks.

It has also changed the nature of financial markets. Take swaps for example. The market has grown to some $500-trillion. The figure of even $500 trillion is misleading because it is only the” notional amount” of capital outstanding in swaps. The actual amount at risk (the money that would be lost if something went wrong) is far less. If a bank undertakes a $100 million interest rate swap, the $100 million is the notional amount. But the bank hasn’t actually handed the money over to anyone, as it would have done with a loan. All it has done is agree with someone else to exchange interest payments on the $100 million. So if the counterparty goes bust, the bank does not stand to lose the capital but only the future interest payments. The actual amount at risk in the swaps market, therefore, is only a small fraction (around 1-3%) of $500 trillion. No reason to worry, say the bankers.

Although it is true that the amount at risk is smaller, the argument ignores the sheer size of the numbers. The BIS estimates that it would cost around 1 % to replace all swaps at current market rates. On a $500 trillion derivatives notional value, even 1 % works out to $5 trillion!! The top 20 banks have a combined capital base much less than this. In the event of a blow-out, this capital will get wiped out in a matter of hours. Then, the collapse of the banking system follows. As so often with derivatives, this figure is a little better than a guess. If market conditions worsen, the replacement cost (the amount at risk) would be higher. If conditions were catastrophic, it might actually become impossible for banks to replace defaulted swaps, in which case the potential losses don’t bear thinking about. The risk represented by $500 trillion when one considers that the swaps and derivatives market is one of the most highly concentrated in the world. More than half of all currency and interest rate swaps are concentrated on the five largest American banks. Many of the rest of the world’s swap business is in the hands of a smaller number of British, Japanese and EU banks. Globally, not more than 20 to 30 of the world’s largest banks are in this. The swaps club is so small that the bulk of the total traffic in swaps is between these institutions. This has tied the international banks together in a web of obligations. It has increased their mutual dependency. These banks are like a group of mountain climbers roped together by their swaps activity; if any one of them falls into a crevasse there is a danger that it will drag the rest of them in with it.

When recession hit the West in the early 1990s, the temptation to speculate became irresistible. With few of their corporate clients wanting to borrow money, they began to gamble their own money in the financial markets to keep up their profits. Since derivatives are the quintessential tools of speculation, they play a leading role in the banks’ propriety dealing activities. By becoming speculators banks are playing a more dangerous game than before.

Then there is operational risks- the danger that a bank doesn’t really know what it is doing. Few financial activities have ever presented such huge operational risks as derivatives trading. But while ordinary investment fund and bank managers grapple with the complexities of hedging with varying degrees of success, there is another kind of fund manager to whom they are the stuff of life itself. These are the hedge funds, the financial pirates whose activities have next to nothing to do with hedging, and whose investment funds float on a sea of derivatives. Many of these hedge funds act as a financial weapon at the service of the Rockefeller and Rothschild Empires.

When a hedge fund collapses (like what happened to LTCM in New York in 1998), the effects are daunting. And it always happens in the midst of some major stock market upheaval. Its assets would be liquidated in a panic creating further market disruptions. To make matters worse, the effects will feed through to the banking sector because hedge funds use huge amounts of bank credit as one of their major sources of leverage. Currently, the leverage of many top hedge funds is 30:1. The fact is that the two largest groups of speculators in the world – the hedge funds and the banks – are connected like Siamese twins. The unavoidable fact about derivatives is that while helping to limit risk, they have also encouraged unprecedented speculation. History suggests that speculation sooner or later leads to disaster. Derivatives have turned the financial markets into a high-tech, 24-hour casino.

Like Warren Buffet stated some years ago that: “Derivatives are WEAPONS OF MASS DESTRUCTION!”

Finance: Derivatives and the Imploding Financial System

Most people don’t understand what derivatives are. Unlike stocks and bonds, a derivative is not an investment in anything real. Rather, a derivative is a legal bet on the future value or performance of something else. Just as one can bet on the horse, or the outcome of a sports game, financiers in London and New York make multi-billion dollar bets on how interest rates, foreign exchange rates, and share prices will perform in the future; or on what credit instruments are likely to default.

A financial derivative is an instrument based on or “derived” from underlying assets such as shares, bonds, commodities or currencies. In general, it is an obligation to buy or sell the underlying asset at an agreed price and time in the future. Since it usually takes only a small down payment (the margin or premium) to purchase such an obligation, any movement in the value of the underlying asset above or below the agreed price can produce immense profits or losses relative to the original down payment.

Financial derivatives have grown from a standing start in the late 1980s to a $2 -3 quadrillion industry by 2022. The world’s GNP stands at about $75 trillion; this is more than 30 times more than the global GNP figure. We are talking about an amount of money that is absolutely mind-blowing.

One thing is clear: derivatives have transformed the financial system. It has never been so easy to move money from country to country and market to market, nor move it so quickly, nor to take on so much risk in the blink of an eye. Derivatives have fundamentally altered the way markets work. In the space of less than 30 years they have become integral to the whole elaborate structure of international finance.

Derivatives were invented to limit, or hedge, risk. In a world of international trade, constantly changing exchange rates, unpredictable interest rates and fluctuating commodity prices, the risks have never looked more threatening. Derivatives enable a company to fix the cost of its foreign exchange or raw materials in advance, or borrow money at a cheaper rate. They make the future a more predictable place. This is good for business, and for everyone else. If you have a mortgage where the interest rate is capped so that it will not rise above a certain level, for example, you own an interest rate call option: a derivative.

Derivatives are not bad in themselves. Used properly and wisely, they are an undoubted benefit. It is when they are used improperly and unwisely that they become the equivalent of a bomb. Think of derivatives as a loaded gun. You can use it in self-defense or murder. Unfortunately, the temptations to use it for the latter purpose are immense. This worries many people in the finance industry. What concerns them is the growing fragility of the financial system they have created. Derivatives have built interconnections between markets that never existed 30 years ago; they have woven international finance into a single fantastically tight and complex tapestry, yet the fabric seems thinner than ever.

A former central banker who has had to grapple with the reality of bank collapses and the threat of systemic financial failure says: “derivatives have the potential to create an unprecedented financial disaster”.

It could happen. If it does, it will almost certainly be in a way that no one has foreseen. It may be triggered by an extraordinary event that nobody in their wildest dreams had imagined. But more likely it will involve nothing more remarkable than the sort of problems that regularly crop up on the markets, only this time the particular combination of events will be so unusual, so unexpected, the results will be lethal. In times of crisis, the financial system reacts in unpredictable ways. The more suddenly the crisis strikes, the worse the trauma is likely to be. Investors, caught off-guard and protecting their own individual interests, will react in all the wrong ways ; governments and financial regulators will be confused and paralyzed, perhaps making mistakes that worsen the situation ; the crisis will spread like lightning across countries and markets, faster than anyone can control until suddenly a local problem has become a global disaster.

Derivative Losses

Stupendous dealing losses have become commonplace. Let us list some of these losses:

- In 1993, Feruzzi, the Italian-based food giant, lost $3 billion on derivatives; Germany’s MG Group lost $1.34 billion; Malaysia’s Bank Negara lost $3 billion.

- In 1994, various hedge funds, municipalities and banks lost $6 billion;

- In 1995, Barings Bank went bust with derivative losses of more than $1 billion;

- In 1996, Daiwa Bank lost $1 billion, and one of the largest trading companies, Sumitomo Corporation, lost $1.7 billion in the copper market;

- In 1997, Yamaichi Securities, Japan’s 4th largest investment bank, went bust on the back of derivative losses. Then UBS, one of the Swiss “Big Three” had huge derivative losses, and was forced to merge with another Swiss bank in order to save the Swiss and European financial system;

- In September 1998, LTCM, a very large hedge fund in New York went bust. It blew a $4 billion hole, and nearly collapsed the international financial system;

- In October 2000, JP Morgan went bust, and was taken over by Chase Manhattan Bank;

- In 2001, it was Enron, and World Com;

- In the mid-2000s, an Italian dairy company, Parmalat went bust on the back of huge derivative losses;

- Then came 2008 – first Lehman Bros went bust, quickly followed by AIG, and a few others.

But not all such blunders become public knowledge. As everyone knows, banking is to a great extent a confidence trick. Banks only last as long as their depositors believe that their deposits are safe, so bankers see it as a duty to reassure the public even if that means misleading them. It is normally not until a bank is in direct trouble that the public ever gets to hear about it.

Just because the financial system did not crack in 2008, does not mean that a somewhat bigger shock could not create the ultimate financial nightmare – what the bankers call systemic risk – because if we can be sure of anything about the financial system is that something will eventually go wrong.

It is not a question of if, but when. These past financial eruptions are but a precursor to the “big one”, a reverse-leverage disintegration of the entire financial system in a matter of days, or hours.

JP Morgan Chase

To give an example: JP Morgan Chase has an equity capital of $ 178 billion; assets (loans) of $2.1 trillion. And a derivative book of $78.7 trillion! This was as of December 31, 2010. That’s 12 years ago. In other words, its equity capital is equal to .24% of its derivative book. A loss equivalent to just .25% of its derivative portfolio would wipe out JP Morgan Chase’s entire equity! The ratios are slightly better for the other large international banks.

That tiny margin between existence and disintegration is a dominant feature of the international financial system today, and this is what has financiers, the regulators, and the politicians terrified. One false move and poof! The whole thing blows.

To understand the nature of the derivatives market, we must leave the world of mathematics, and enter the world of parasites.

Picture a dog with a very bad case of fleas, the dog representing the productive sector of the economy, and the fleas representing the worst elements on Wall Street. During the 1970s and 1980s, the fleas built up huge trading empires, trafficking in the flesh and blood of the dog. The fleas were so successful that the once-powerful dog began to dramatically weaken, and no longer produced enough blood to allow the fleas to continue trading in the manner to which they had become accustomed.

Being clever critters, the fleas came up with a solution that pleased them all. They began trading in blood futures. Since they were trading in futures rather than the actual “product”, they were no longer limited by the amount of the blood they could suck from the dog. The level of trading expanded dramatically, and the fleas became rich beyond their wildest expectations. Right up to the point that the dog died. That, in essence, is the nature of today’s derivatives markets, and the global financial system as a whole.

In the brave new world of derivatives, the big banks have blown up with some regularity; the landscape is littered with the detritus of derivative failures.

To sum up: the huge mass of financial values in the world economy has the form of an inverted pyramid. On the bottom of the pyramid, we have the actual production of material goods. Above that, is the commercial trading in commodities, and real services. Above that, we have the complex, interconnected structure of debt, stocks, currency trading, commodities futures, and so on. Finally, at the top, we have derivatives and other forms of purely fictitious capital. This strange object is growing in a very unbalanced way: the upper layers – starting with derivatives – grow much faster than the lower layers. But, what is happening at the very thin base of the pyramid, which represents the real, physical economy?

Actually, it is not growing at all. In fact, the world’s physical economy has been stagnating, even declining, since the 1970s. Looking at the situation for the world as a whole, we can see that the portion of physical output flowing back into agriculture, industry, and infrastructure has been decreasing. At the same time, fictitious capital is growing at an accelerating rate.

What is actually happening, is that the productive base of the world economy is being ‘sucked to death’ by the pyramid –shaped financial bubble. This is most clearly seen by the effect of the massive debt accumulation, which is causing farms and industries, and even entire governments, to shut down. The whole financial bubble depends, directly and indirectly, on squeezing “increasing amounts of income flows” from the material base of the world economy- what is known as the physical economy. And these bankers will do anything to increase income streams, or create new ones through privatizations, or invading a country, and use those nations’ resources.

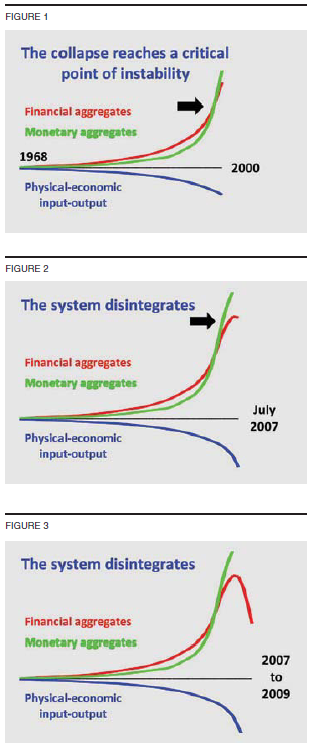

Below, is the famous TRIPLE CURVE FUNCTION, authored by world renowned economist Lyndon LaRouche Jnr. For further reference on this subject of physical economy, visit the EIR website, via LaRouchepub.com.

The emphasis of this design was placed on the matter of relative directions of changes in relationships among these three subjects.

The post-2008 period has been a qualitative shift in the direction of these three elements, between a continued, and actually accelerating rate of skyrocketing of a hyperinflationary monetary expansion, relatively, first of all, to an accelerating collapse of the financial level, and, secondly, an accelerating collapse of the physical and related output of employment of and productive output of the labor-force.

These three directions in economy, not only in the U.S. economy, but world-wide, suffice to define the existence of a presently ongoing general breakdown-crisis, one which is collapsing in every part of the world economy, if at somewhat differing local rates in each and all sections of the world economy. This has been in accelerating progress since November 2008, while nothing of any palpable effectiveness has been done, in the known case of any government, or supranational institution of the world, to stop it.

Obviously, not only has neither Washington or the EU nor the nations of Central and South America, taken even the meanest palpable steps, to do anything about this combined hyperinflationary-deflationary, breakdown-crisis, but each and all have refused even to admit that this greatest hyper-inflationary breakdown crisis in all known world history even exists.

As one can see from the above 3 triangles, 1975, 2000, 2022 the yellow portion represents derivatives. This process has killed off the productive economy- represented in orange. Yellow is the fleas, and orange represents the dog, i.e. the dog being the physical, productive economy. The West has transitioned from a physical economy to a virtual economy. Virtual economies are not sustainable. This glaring weakness of the Western financial system has resulted in falling profit margins, thus, forcing the bankers to continuously look for additional “income streams to support the losses incurred by the financial system. It has reached a point that the underlying physical economy is unable to feed the financiers. When this point is reached, the hyper-inflationary system just implodes. We are at that stage now.

Meanwhile, in the Global South, it is not as bad as compared to the Collective West. Resource rich, and burdened with less debt, and now, once more being able to breathe, their economies are on a rising trajectory. In the Global South, industrial production is strong, agriculture is strong, debts are low, a strong and educated workforce. Even better, moral and spiritual values are high, and there is no LBGT, transgender and WOKE nonsense. Rather, the Global South has COMMON SENSE, rationality and Logics.

For these reasons and more, the Global South will be a much better place to live and raise our families. The governments of the Collective West refuse to recognize the actual present situation,perhaps on grounds of sovereign claims of impotence. They, are thus, willing condemn the people of the nations of this planet, to a prolonged new dark age, during which it were likely that the present level of world population would collapse rapidly, through famine and epidemic, from a present 8 billion, to two, or less? At this time of a deepening and accelerating onset of a world-wide, chain-reaction-style, breakdown-crisis of the entire system, the citizens of the Collective West will strike, protest , riot, loot and rampage against their leaders and governments . This is a breakdown-process, already at full tilt, which, if allowed to continue, without needed reversals of the current policies of most nation’s financial system as a whole, will shatter Western civilization as we know it.

This has only benefitted the highly corrupt, financial-derivatives-polluted trash, most notably, by the Wall Street and London financial-speculators’ community. In light of that fact, the entire world financial community, especially North America and Europe, had to be considered as now hopelessly rotten to the core financially. With its skyrocketing, already hyper-inflationary mass of worthless speculative paper, there is no possibility, now, of preventing any part of a world financial system which has significant ties to the North American and European financial-monetary systems, from falling into a breakdown form of chain-reaction collapse throughout the planet. Almost at the very moment that the U.S.A. itself becomes officially a victim of a general state of bankruptcy of the of the U.S.A., there would be a general, chain-reaction mode of breakdown of the society of the entire planet, a breakdown brought about through a plunge of the planet, chain-reaction style, into a greater catastrophe, this time on a global scale, than the Fourteenth-century “new dark age,” which wiped out approximately one third of the population of Europe.

The crucial point to be made is shown most efficiently by the model of an updated version of Triple-Curve Function. Since October 2008, while the physical output of the economy has continued

to fall at an accelerated rate, an onrushing financial depression in financial output, as presently in progress, has been contrasted with the actuality of a soaring hyper-inflationary rate of monetary inflation, thus creating a simultaneous hyper-inflationary/deflationary stress in the ratio of monetary to financial aggregate, that at the same time that physical output of the economy is declining still now, at an accelerating rate. These are, precisely, the appropriate symptoms of an onrushing collapse of the entire economy of the planet, for as long as the present system of practice is continued. Only an immediate general reorganization in bankruptcy could save civilization from this now impending, accelerating rate of global breakdown-crisis. It is necessary to eliminate the monetary factor through bankruptcy-reorganization conducted by government, while pouring in long-term State credit for funding a recovery into urgently needed forms of basic economic infrastructure, especially physical infrastructure, and increased productive employment through pouring of that State credit into investment in essential forms of basic economic infrastructure and industries associated with the building and uses of that infrastructure.

A Global Challenge

There is a specific remedy now absolutely required for this type of breakdown-crisis. The key to that remedy is the reinstatement, by the U.S.A., of the Glass-Steagall standard; otherwise the outcome will be a form of chaos from which no recovery of the nation were to be presumed at this time.

By restoring that standard, for the case of the U.S.A., and through aid of coordinated agreements with Russia, China, and India, among other cooperating nations, it were feasible to perform the virtually instantaneous “miracle” of cancelling all financial claims which do not meet the equivalent of Glass-Steagall standards, and, virtually ending the existence of the presently hopelessly bankrupt monetary system, especially the fictitious derivatives markets.

As soon as the EU break from the British imperial “Euro” system, those nations, too, would be enabled to join that reorganization of the world system with the U.S.A., Russia, China, India, and others, in a change from a monetary system, to a world-wide network of respectively sovereign, national credit-systems constituted as a global, fixed-exchange-rate credit system . The result of that combination of developments would be a system, issuing new national credit-loans over a period of a half-century (and wiping the vast mass of “bad,” fictitious debt from the books), for rapidly rebuilding the world economy through major ventures in construction of urgently needed basic economic, public infrastructure among cooperating nations, freed from the evils of globalization, to return to the practice of being once more truly sovereign nation-state republics.

The difficulties of comprehension, especially in Europe and among other nations trapped in the legacy of British global imperial monetarism, are chiefly products of the . The key to the needed change from a hopelessly ruined monetary system, to the global array of a fixed-exchange rate set of credit systems is a matter of science, not mere opinion, especially in light of the peculiar character of the global crisis which confronts the largely “dumbed-down” and “ mis-educated” world as a whole today. Teaching people WHAT to think, instead of HOW to think, produces idiots instead of smart people.

This brings us to a crucial issue, which is not entirely a new issue in the history of civilized society, but is an extremely urgent, immediate issue, today. The remedy for this crisis is to for launch the kind of program of fundamental scientific progress, which would lead our planet, over the course of coming decades, through certain, urgently needed, great reforms in principles of the world’s economy as a whole.

This is the background for the call of globalization and free trade by New York and London. When nations around the world subscribe to these policies, they leave their economies wide open to be looted by these two networks. Both London and New York are desperately trying to prop up the financial bubble, and it needed to “open” the economies of various nations, in order to facilitate its looting of these economies. When these nations resist, their leaders are destabilized by “political scandals”, or worse, when the entire nation itself is targeted for destabilization. America is very close to bankruptcy. It survives only by the tyrannical use of raw political, financial, and military power, to exact tribute from much of the rest of an already looted world. The world has been pumping roughly $3-$5 billion per day into the US, in order to keep America going. Now, they have become very tired.

The current economic and financial crisis is not something which might happen. It is something that is already underway. What we do not know at this stage is that when the already existing, hopeless bankruptcy of the system will explode into the streets – is whether this will occur as a single event, to as a cumulative effect of a chain-reaction series of crisis, ricocheting around the world. Whenever these two networks find their economic, financial, and political systems threatened, they react with VIOLENCE. In other words, when they cannot control the world by means of their financial and economic systems, they use the desperate action of the FIST to destroy and crush anybody who might be in their way.

We are now in such a period. We have the worst finance and monetary crisis in modern history. While the financial elite are bailing out of the stock markets, fools like us are persuaded to buy yet more shares in the same markets.

All the largest bank groups are technically bankrupt. The situation in Europe is even worse. Of the estimated 40 trillion Euros of loans on its books, almost 25%, or 10 Trillion worth, are ‘non-performing’. These loans cannot be repaid to the European banks. At the heart of the EU banking cartel are the Rothschild-controlled banks. They are, without exception, all broke. With every passing day, the demands for austerity coming from the financiers of the Anglo-American empire grow louder. Governments worldwide are being told that they must slash their budgets, cut their services, and shred their social safety nets, and cast their populations to the wolves, all in the name of “fiscal responsibility.” “All available resources must be funneled to us,” the financiers shriek. “We need the money, and the people must fend for themselves!”

The key reason for the COVID program was to reduce demand for credit by the private sector, in order that the financial system uses the available credit to prop up its dying system. At the same time, the financier networks that are making these inhuman demands are continuing to loot the planet through a variety of open and hidden bailout schemes, currency manipulations, derivatives scams and bio-warfare– in short; these sanctimonious and hypocritical bastards continue to steal us all blind – destroying the basis for our very existence.

As explained before, there are two financial networks of power in the world today. One is based in New York, and is headed by the Rockefeller family. The other is based in London, and is headed by the Rothschild family. The banks on Wall Street, the City of London, and Switzerland is a conduit for these oligarchic families, and their wealth and power. It represents a predatory system which exists by keeping mankind as peasants, to be looted as required, and cast aside when they are no longer useful. It is the face of the enemy. Despite the trillions of dollars of bailout money from the Federal Reserve and the European Central Bank, the banks of these 2 families are still hopelessly broke. Thus, the spectacle of the lords of the empire robbing the Global South blind, in the hope of sucking the last dollar out of a dying world, before it all collapses.

The way to defeat this lawless imperial mob is to use the power of the nation-state. The empire, as a predatory phenomenon, essentially operates according to the law of the jungle, where the strong eat the weak. It survives by bestializing man, making him a slave to his impulses and senses. Basically, it survives by making sure that its subjects are too stupid and self-absorbed to effectively resist imperial rule. (Sound familiar?). We will do one example of this madness called derivatives.

The Russian Default & the LTCM Crisis

Ever since 1991, Russia has been walking a financial tightrope. In order to maintain funding of the Russian government, Moscow began to issue government bonds- known as GKO bonds. Russia was not prepared for the change from communism to capitalism, as the transition literally occurred overnight. As a result, it was lacking the necessary infrastructure to collect taxes. Furthermore, most of the companies in Russia were state-owned, and most of these were trading at a loss. The concept of profits was non-existent. Since not enough tax was being collected, and the government was in no position to continue subsidizing losses at these companies, Moscow was forced to borrow money.

As its economic and financial situation deteriorated, Moscow, in order to continue borrowing money, was forced to offer even higher interest rates. With the onset of the Asian Crisis in June 1997, the interest rates on GKO bonds was reaching 30%, with maturity periods of less than one year. It was a position that was not sustainable.

In the meantime, in New York City, a hedge fund called Long Term Capital Management, or LTCM, a Rothschild entity, was thriving in all this chaos and upheaval. It bet big on the interest rate yields of US Treasury bonds, and on GKO bonds. It was betting that yields on GKO bonds would come down, while the yields on US Treasuries will go up. July 17th, was a red flag day for stock markets. Share prices started dropping, and dropping fast. As markets crashed around the world, devastating currencies, money fled to the safe havens of New York, and into US Treasury bonds, which brought the yields DOWN. In Russia, GKO bond yields shot up to 50%, with a maximum of 30-day maturities.

On August 17th, Russia defaulted on its GKO bonds. Coming on top of falling markets, the impact of Russia’s default was serious, as the stability and solvency of many banks were hanging in the balance. LTCM now had to pay the price of betting wrong. To add insult to injury, LTCM could not pay out its counterparties. It was by now obvious that LTCM was broke. It had a capital of $4 billion and a derivative book of $1.5 trillion – 375 times its capital base! At this point in time, the Rothschilds realized that they had made a huge mistake, and they scrambled to contain the damage. Furthermore, the collapse of LTCM had created a nightmare of a problem on the inter-bank payment system. The interbank payment system is the arteries through which flow the smooth running of the international banking system. If it is disrupted, then the banking system would suffer a massive heart attack. In order to save the system from collapsing, the Federal Reserve pumped huge amounts of liquidity into the system. This was done to ensure that no gridlock ensued. Had that happened, the world would have entered into a new dark age. Michel Camdessus, the head of the IMF, in a private meeting with French bankers some two years later, stated that had there been a second hedge fund collapse, then nothing would have been able to save the international financial system. He said, “We were staring into the abyss”. Had the Fed and the banks not intervened to protect LTCM’s derivative exposure, LTCM would have defaulted on its debts the next day, blowing a trillion dollar hole in the derivatives markets, and likely setting off a chain-reaction of defaults which could have brought down the entire financial system. The head of the New York branch of the Federal Reserve hinted at this: “Had LTCM been suddenly put into default, its counterparties would have immediately “closed out” their positions. However, if many firms rush to close out hundreds of billions of dollars in transactions simultaneously, they would be unable to liquidate collateral or establish offsetting positions at the previously existing prices. Markets would move sharply and losses would be huge. Several billion dollars in losses might have been experienced by some of LTCM’s more than 75 counterparties. As the losses spread to other market players and LTCM counterparties, this would lead to tremendous uncertainty about how low prices would move, and there was a likelihood that a number of credit and interest rates would cease to function for a period of 3 days or longer. This would cause a vicious cycle : a loss of investor confidence, leading to a rush out of private credits, leading to further liquidations of positions, and so on “. In short, a reverse-leverage chain reaction.

So, at any cost, LTCM had to be saved. Since it was New York, the king of America, David Rockefeller swung into action. A deal was done between David, and the head of the Rothschild family, Evelyn Rothschild. The gist of the deal was that a consortium of banks would take over LTCM, unwind its position across the board with its 75 counterparties, and eventually shut it down. The rescue costs came to somewhere in the region of $50 billion.

Stock market losses since 17 July through to 20 September 1998 were as follows: – Brazil $121 billion, Japan $317, Hong Kong $30 billion, Germany $165 billion, Russia $122 billion and the US $2 trillion. This is just a sampling of some of the countries, and is not the total list. Since mid-July, stock markets went into a free-fall. Most of the major players in the financial markets place their bets on margin, or with borrowed money, greatly increasing their potential profits, through leverage. As long as the markets are rising, tremendous amounts of money can be made through leverage. But the reverse is also true. When the markets drop, the leverage goes into reverse, and losses grow even faster than did profits. When markets are dropping, players are often forced to sell assets at a loss to meet margin calls, and, the more the players are forced to sell, the faster prices drop, which in turn forces more selling. The effect of this reverse leverage is even greater in the derivatives markets.

Do remember, that markets are ruled by greed and fear, and fear was ruling the markets at that time.

The story continues in the next part of this article, https://behindthenews.co.za/the-end-of-dollar-hegemony-part-3-of-a-4-part-series/