In September 2019, Wall Street had a triple cardiac event. The Feds’ Repo window went crazy. A normal weekly repo activity amounts to an average $50 billion. In mid September, over a period of 2 weeks, the Fed lent out an astounding $600 billion plus! This shocked David Rockefeller Jnr (the head of the family), and 3 weeks later, an emergency meeting was called by him. His key people in “population control” were present. David Jnr gave the orders to initiate the lockdown of the global economy, via the con which came to be known as Covid ! The aim – to REMOVE DEMAND FOR CREDIT from the global economy, so that whatever credit is available, would go to supporting the liquidity and solvency of the American and global financial system, of which his family and the Rothschild family were owners and key beneficiaries.

The next step after this was to target China’s economic growth, through trade tariffs, sanctions, hybrid warfare, etc. This did not work. After this, David Jnr set his sights on Russia, a plan long in the making. The aim was to provoke Russia to attack the military force built up by NATO, on Russia’s western border. If Russia attacked, then Wall Street and the City of London would apply financial and economic war on Russian hoping to weaken it to such an extent, that the people of Russia would “regime-change” the Putin government. That was the plan. Tyrants plot and plan, but God is the best of all planners.

The judo master Putin counter-attacked economically and financially. Putin passed 2 decrees; all Russian energy exports to be sold in rubles, and that the ruble would now be backed by gold ! These 2 moves signaled the beginning of the end for the empires of these 2 families.

The dollar was backed by nothing but the US military, and confidence in American economic power. Within a short time, the US military was exposed as a “paper tiger”, especially after the fiasco of the Kabul retreat ended in utter humiliation for America Inc. The confidence in the economy was shaken by the Covid drama. Finally, the so-called “safe haven of the dollar’s status was shattered when the US stole $300 billion of Russia’s foreign reserves. This was the culmination of a series of thefts by Washington (Venezuela, Syria, Libya, Iraq, etc.). All of these factors crushed “confidence” in the dollar.

Wise investors (big and small) began withdrawing from the dollar market, and they parked their funds and assets in non-dollar markets. In order to maintain the fiction of confidence in the dollar, the Fed began raising interest rates. It was in March 2022, that the rates began to increase, from 0.5% to now at 5%. This is a 10 fold increase, or a 1000%, in 12 months. It does not take rocket science to figure where this is going.

The implications of all this will impact most on our economy , money, society and lifestyle, especially for the citizens in the Collective West, aka Zone A. Here, we will look at 2 of the most fundamental issues in our modern society- energy and money. Let’s look at energy first.

Looming Energy Shortages Imply Economic Dislocations

Since 2014, the Rockefeller Empire began to cut back on investment in the oil and gas sectors. The impact is being felt today.

Energy shortages could have a more significant impact on the economy than originally anticipated. When energy per capita falls, it becomes increasingly difficult to maintain the complexity that has been put in place. It becomes too expensive to properly maintain roads, electrical services become increasingly intermittent, and trade is reduced. Long waits for replacement parts become common. These little problems build on one another to become bigger problems. Eventually, major parts of the world’s economy start failing completely. There are many other changes, as well, as fossil fuel energy per capita falls. Without enough energy products to go around, conflict tends to rise, and economic growth slows and turns to economic contraction, creating huge strains for the financial system.

- The educational system is part of complexity.

- International trade is part of complexity.

- The financial system, with its money and debt, is part of complexity.

- The electrical system, with all its transmission needs, is part of complexity.

- Roads, railroads, and pipelines are part of complexity.

- The internet system and cloud storage are part of complexity.

The big danger, as energy consumption per capita falls, is that the economy will start losing complexity. In fact, there is some evidence that loss of complexity has already begun

We know that, in the past, economies that collapsed lost complexity. In some cases, tax revenue fell too low for governments to maintain their programs. Citizens became terribly unhappy with the poor level of government services being provided, and they overthrew the governmental system.

The world’s economy is a physics-based system, called a dissipative structure.

Energy products of the right kinds are needed to make goods and services. With shrinking per capita energy, there will likely not be enough goods and services produced to maintain consumption at the level citizens are used to. Without enough goods and services to go around, conflict tends to grow.

Instead of growing and experiencing economies of scale, businesses will find that they need to shrink back. This makes it difficult to repay debt with interest, among other things. Governments will likely need to cut back on programs. Some governmental organizations may fail completely.

When customers are faced with higher prices because of spiking inflation rates, they will tend to reduce spending on discretionary items. For example, they will go out to eat less and spend less money at hair salons. They may travel less on vacation. Multiple generation families may move in together to save money. People will continue to buy food and beverages since these are essential.

Businesses in discretionary areas of the economy will be affected by this lower demand. They will buy fewer raw materials, including energy products, reducing the overall demand for energy products, and tending to pull energy prices down. These businesses may need to lay off workers and/or default on their debt. Laying off workers may further reduce demand for goods and services, pushing the economy toward recession, debt defaults, and thus lower energy prices.

We find that in some historical accounts of collapses, demand ultimately falls to close to zero.

In the US, the volume of energy available is decreasing. The clearest indicator of this is looking at the Strategic Petroleum Reserves, or the SPR. At its height point, the SPR reached 726 million barrels. It has now dropped to around 410 million barrels as at January 2023. Last year, around 180 million barrels were withdrawn. Now, Washington is planning to release another 180 million this year!

What happens after that, when energy availability is decreasing?

This is DELIBERATE. The Rockefeller Empire is restricting the flows of energy and food in order to bring about their Great Reset program.

Here, we will briefly explain the control over areas that are crucial for human existence. They are food, raw materials, energy and finance. The two families and their allied networks in London (the Rothschilds) and New York (the Rockefellers) have increased their control over all aspects of life – especially and most critically in these above 4 areas.

The British American Cartel or BAC

At the heart of the British-American-Commonwealth clique, run by the super-wealthy families of the oligarchy (MEANING THE 2 FAMILIES AND THEIR NETWORKS OF POWER), is a combined economic and financial power greater than any single nation-state on Earth. The BAC has been busy, in preparation for the biggest financial implosion in history, which some insiders are acutely aware of—unlike the babblers at the Wall Street Journal and other financial press, who fantasize about the “eternal stability” of the system.

There has been an intense consolidation, tightening the BAC’s death-grip over the production of goods necessary for human life. Under BAC control are 3-4,000 corporate entities. Although they maintain the fiction of corporate independence, their boards of directors are so multiply interlocked that it is difficult to tell one corporation from another. They are really one entity. In groups of 10 to 50 firms, they are formed into cartels, which dominate 50-90% of the economic activity in critical sectors: precious metals, base metals, strategic minerals, oil and energy, food supplies, and finance. As the rate of financial disintegration has accelerated, the BAC clique has hoarded commodities, often buying the source of production, from the mines to the oil fields, from which commodities are extracted or produced.

The financiers behind the BAC reason thus: “The Mountain of financial instruments in the world will soon collapse and be worth very little. If, when the dust clears, we can own 70% of food, energy, metals, and strategic minerals, we will still dominate the world.” The BAC’s hoarding poses a potentially devastating danger to mankind: Its policy is the neo-Malthusian policy which Henry Kissinger promulgated in 1974 as U.S. Secretary of State, under his National Security Study Memorandum 200. NSSM-200 outlined a policy of genocide and depopulation against the Third World, and ultimately, against the industrialized sector.

Through consolidation of 70% or more ownership of raw materials, the BAC has put within its grasp the power to cut back the production-flow of every kind of agricultural produce and raw material that is needed for people to eat, or, worked up from raw materials to capital and other finished goods, that is required for modern society. By squeezing off these flows, production would be crippled, to the point that mankind would be reduced to 500 million semi-literate souls roaming the Earth—achieving the paradigm desired by the 2 families. The immense physical goods and financial power of the BAC cartel is not reported in university textbooks or in the media. The latter focus on how much the stock of Facebook is worth, or what is going on with Tesla or with other Internet stocks, but it has given little coverage of how the BAC has been building up immensely its power. The current crisis in all 3 (energy, food and raw materials) of the above areas was initiated by the 2 families starting in 2014. Lower investments in these areas have resulted in demand outstripping supply, thus pushing up prices.

Back in 1990, the EU had a greater PPP GDP than did either the US or China. Now, the US is a little ahead of the EU. More importantly, China has come from way behind both the US and EU, and now is clearly ahead of both in PPP GDP.

We often hear that the US is the largest economy, but this is only true if GDP is measured in current US dollars. If differences in actual purchasing power are reflected, China is significantly ahead. China is also far ahead in total electricity production and in many types of industrial output, including cement, steel, and rare earth minerals. The total production capacity (industrial and consumer) of China is GREATER than the production of the EU and the US combined!

Derivatives – a ticking time bomb & the ultimate weapon of mass destruction

Banks, in order to boost profits and recover from past losses, began to speculate in financial markets. The most dangerous instrument born in the late 1980s was derivatives. It is the greatest “weapon of mass destruction “, as per Warren Buffet (a prime example of a Rockefeller front man). Over the past 30+ years, derivative losses have destroyed many banks and companies. But, instead of cutting back on the use of derivatives, the banks have doubled down.

In the current period, the banks are in an even worse position. This is due to derivative transactions which have no underlying asset to back up such trades. It is basically a casino. Add a bloated stock market, a falling economy, increasing unemployment, social chaos, etc., – the environment for the financial system has turned hostile.

All instruments being issued now by banks, pension funds, stock funds, it’s all synthetic. Therefore, my estimate for derivatives would be at least $2 quadrillion, and I think that is probably conservative. Then, we have debt on top of that of $300 trillion, and we also have a couple hundred trillion dollars of unfunded liabilities. So, we are talking about $2.5 quadrillion, and that’s with a global GDP of $80 trillion. So, there is a disaster waiting to happen, and especially because all this printed money has created no value whatsoever. I always knew this would collapse, and it’s taken longer than I expected, but I think we are at the end of a major era.

Financial & Economic Meltdown

These derivatives, at some point in the coming few years, will actually turn into debt. Central banks will have to cover all the outstanding liabilities of the commercial banks as we are seeing now with Credit Suisse, Bank of England and etc. This is going to happen across the board. Whether it’s called derivatives or called debt, as far as I am concerned, it’s the same thing. It will have the same effect on the world financial system, which will be disastrous, of course.

The derivative markets were simply a way for financial institutions to carry debt and not show it on their balance sheets. In the end, everything will balance out. Nobody can repay the debt, and they can’t even pay the interest, therefore, when the debt implodes, so will the assets that were financed by this debt.

So, both sides of the balance sheet have to come down. Whether it comes down by 50%, 75% or 90%, I don’t know. I think about risk, and the financial system will not survive in its present form. Central banks only use one kind of medicine, and that is more printed money. Until recently, depositors and investors were getting negative returns on printed money. So, that is not going to save anything.

Sadly we are looking at a situation when this system will start to implode. Overall in the UK, Germany and most European countries, people don’t have enough money to live. This is a human disaster already. With food costs going up 50 % and energy costs rising even faster along with interest rates and rents, people don’t have enough money, and that is happening now.

It’s a human disaster of mega proportions. The risk is increasing exponentially. So, people should be prepared . . . Most asset markets have lost money, and it is going to get worse. Default. Or, steal the money belonging to the depositors of the bank.

A more detailed article on this issue is called “ICE NINE (How the Elites Are Stealing Your Money)” , dated 10 February,2018.

When nations around the world subscribe to the policies of globalization and free trade by New York and London, they leave their economies wide open to be looted by these two networks. Both London and New York are desperately trying to prop up the financial bubble, and it needed to “open” the economies of various nations, in order to facilitate its looting of these economies. When these nations resist, their leaders are destabilized by “political scandals”, or worse, when the entire nation itself is targeted for destabilization. America is very close to bankruptcy. It survives only by the tyrannical use of raw political, financial, and military power, to exact tribute from much of the rest of an already looted world. The world has been pumping roughly $5 billion per day into the US, in order to keep America going. Now, they have become very tired.

The current economic and financial crisis is not something which might happen. It is something that is already underway. What we do not know at this stage is that when the already existing, hopeless bankruptcy of the system will explode into the streets – is whether this will occur as a single event, or as a cumulative effect of a chain-reaction series of crisis, ricocheting around the world. Whenever these two networks find their economic, financial, and political systems threatened, they react with VIOLENCE. In other words, when they cannot control the world by means of their financial and economic systems, they use the desperate action of the FIST to destroy and crush anybody who might be in their way.

We are now in such a period. We have the worst finance and monetary crisis in modern history. While the financial elite are bailing out of the stock markets, fools like us are persuaded to buy yet more shares in the same markets.

But not all such blunders become public knowledge. As everyone knows, banking is to a great extent a confidence trick. Banks only last as long as their depositors believe that their deposits are safe, so bankers see it as a duty to reassure the public even if that means misleading them. It is normally not until a bank is in direct trouble that the public ever gets to hear about it.

Just because the financial system did not crack in 2008, does not mean that a somewhat bigger shock could not create the ultimate financial nightmare – what the bankers call systemic risk – because if we can be sure of anything about the financial system is that something will eventually go wrong. It is not a question of if, but when. These past financial eruptions are but a precursor to the “big one”, a reverse-leverage disintegration of the entire financial system in a matter of days, or hours. To give an example: JP Morgan Chase has an equity capital of $ 178 billion; assets (loans) of $2.1 trillion. And a derivative book of $78.7 trillion! This was as of December 31, 2010. That’s 12 years ago. In other words, its equity capital is equal to .24% of its derivative book. A loss equivalent to just .25% of its derivative portfolio would wipe out JP Morgan Chase’s entire equity! The figures have worsened since. The ratios are slightly better for the other large international banks.

That tiny margin between existence and disintegration is a dominant feature of the international financial system today, and this is what has financiers, the regulators, and the politicians terrified. One false move and poof! The whole thing blows.

To understand the nature of the derivatives market, we must leave the world of mathematics, and enter the world of parasites. Picture a dog with a very bad case of fleas, the dog representing the productive sector of the economy, and the fleas representing the worst elements on Wall Street. During the 1970s and 1980s, the fleas built up huge trading empires, trafficking in the flesh and blood of the dog. The fleas were so successful that the once-powerful dog began to dramatically weaken, and no longer produced enough blood to allow the fleas to continue trading in the manner to which they had become accustomed. So, starting in the 1990s, being clever critters, the fleas came up with a solution that pleased them all. They began trading in blood futures. Since they were trading in futures rather than the actual “product”, they were no longer limited by the amount of the blood they could suck from the dog. The level of trading expanded dramatically, and the fleas became rich beyond their wildest expectations. Right up to the point that the dog died. That, in essence, is the nature of today’s derivatives markets, and the global financial system as a whole. The dog is the economy. The fleas are the parasites of Wall Street (Rockefeller) and London (Rothschilds).

In the brave new world of derivatives, the big banks have blown up with some regularity; the landscape is littered with the detritus of derivative failures.

| A= physical economy (orange) B= trade & services(red) C = FIRE (finance, insurance, real estate) (green) D = derivatives (yellow) |

To sum up: the huge mass of financial values in the world economy has the form of an inverted pyramid. On the bottom of the pyramid, we have the actual production of material goods. (ORANGE)

Above that, is the commercial trading in commodities, and real services (RED).

Above that, we have the complex, interconnected structure of debt, stocks, currency trading, commodities futures, and so on (GREEN).

Finally, at the top, we have derivatives and other forms of purely fictitious capital. This strange object is growing in a very unbalanced way: the upper layers – starting with derivatives – grow much faster than the lower layers (YELLOW).

But, what is happening at the very thin base of the pyramid, which represents the real, physical economy? (ORANGE)

Actually, it is not growing at all. In fact, the world’s physical economy has been stagnating, even declining, since the 1970s. Looking at the situation for the world as a whole, we can see that the portion of physical output flowing back into agriculture, industry, and infrastructure has been decreasing. At the same time, fictitious capital is growing at an accelerating rate.

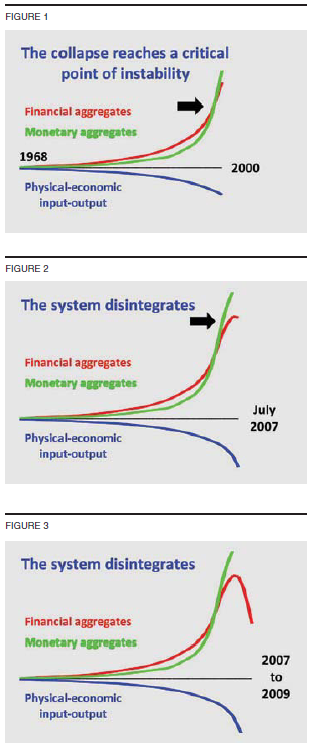

What is actually happening, is that the productive base of the world economy is being ‘sucked to death’ by the financial bubble. This is most clearly seen by the effect of the massive debt accumulation, which is causing farms and industries, and even entire governments, to shut down. The whole financial bubble depends, directly and indirectly, on squeezing “increasing amounts of income flows” from the material base of the world economy- what is known as the physical economy. And these bankers will do anything to increase income streams, or create new ones through privatizations, or invading a country, and use those nations’ resources. Below, is the famous TRIPLE CURVE FUNCTION, authored by world renowned economist Lyndon LaRouche Jnr. For further reference on this subject of physical economy, visit the EIR website http://www.LaRouchepub.com.

These three lines represents the monetary process (green line); the financial process (red line); and, the process of the physical economy measured per capita and per square kilometer blue line).

The emphasis of this design was placed on the matter of relative directions of changes in relationships among these three subjects.

The post-2008 period has been a qualitative shift in the direction of these three elements, between a continued, and actually accelerating rate of skyrocketing of a hyperinflationary monetary expansion, relatively, first of all, to an accelerating collapse of the financial level, and, secondly, an accelerating collapse of the physical and related output of employment of and productive output of the labor-force. These three directions in economy, not only in the U.S. economy, but world-wide, suffice to define the existence of a presently ongoing general breakdown-crisis, one which is collapsing in every part of the world economy, if at somewhat differing local rates in each and all sections of the world economy. This has been in accelerating progress since November 2008; while nothing of any palpable effectiveness has been done, in the known case of any government, or supranational institution of the world, to stop it. Obviously, not only has neither Washington or the EU have taken even the meanest palpable steps, to do anything about this combined hyperinflationary-deflationary, breakdown-crisis, but each and all have refused even to admit that this greatest hyper-inflationary breakdown crisis in all known world history even exists.

The West has transitioned from a physical economy to a virtual economy. Virtual economies are not sustainable. This glaring weakness of the Western financial system has resulted in falling profit margins, thus, forcing the bankers to continuously look for additional “income streams” to support the losses incurred by the financial system. It has reached a point that the underlying physical economy is unable to feed the financiers. When this point is reached, the hyper-inflationary system just implodes. We are at that stage now.

Meanwhile, in the Global South, it is not as bad as compared to the Collective West; resource rich, their economies are on a rising trajectory. In the Global South, industrial production is strong, agriculture is strong, and they have a strong and educated workforce. Even better, moral and spiritual values are high, and there is no LBGT, transgender and WOKE nonsense. Rather, the Global South has COMMON SENSE, rationality and Logics. Plus, let us not forget China’s multi-trillion dollar BRI project that is building up physical infrastructure around the world-mainly in the Global South, or the Zone B countries.

Just to clarify, look at the 2 images. The first is Russia. It has a high production base, a strong FIRE sector, and practically no financial speculation aka derivatives. In short, Russia’s future is looking very positive.

The second is China. China has a larger production base than the combined US/EU put together. It has a strong and stable FIRE sector. Unfortunately, the Chinese love speculation and gambling. Add to this is the fact that Wall Street has a powerful presence within China’s FIRE sector. Xi Jinping is working steadily and ruthlessly to eliminate those working for either Wall Street or the City of London. China will get there soon.

For these reasons and more, the Global South will be a much better place to live and raise our families. The governments of the Collective West refuse to recognize the actual present situation, perhaps on grounds of sovereign claims of impotence. They, are thus, willing condemn the people of the nations of this planet, to a prolonged new dark age, during which it were likely that the present level of world population would collapse rapidly, through famine and epidemic, from a present 8 billion, to two, or less? At this time of a deepening and accelerating onset of a world-wide, chain-reaction-style, breakdown-crisis of the entire system, the citizens of the Collective West will strike, protest , riot, loot and rampage against their leaders and governments . This is a breakdown-process, already at full tilt, which, if allowed to continue, without needed reversals of the current policies of most nations’ financial system as a whole, will shatter Western civilization as we know it.

This has only benefitted the highly corrupt, financial-derivatives-polluted trash, most notably, by the Wall Street and London financial-speculators’ community. In light of that fact, the entire world financial community, especially North America and Europe, had to be considered as now hopelessly rotten to the core financially. With its skyrocketing, already hyper-inflationary mass of worthless speculative paper, there is no possibility, now, of preventing any part of a world financial system which has significant ties to the North American and European financial-monetary systems, from falling into a breakdown form of chain-reaction collapse throughout the planet. Almost at the very moment that the U.S.A. itself becomes officially a victim of a general state of bankruptcy, there would be a general, chain-reaction mode of breakdown of the society of the entire planet, a breakdown brought about through a plunge of the planet, chain-reaction style, into a greater catastrophe, this time on a global scale, than the Fourteenth-century “new dark age,” which wiped out approximately one third of the population of Europe.

A Global Challenge

By restoring sanity for the case of the U.S.A., and through aid of coordinated agreements with Russia, China, and India, among other cooperating nations, it were feasible to perform the virtually instantaneous “miracle” of cancelling all financial claims , and, virtually ending the existence of the presently hopelessly bankrupt monetary system, especially the fictitious derivatives markets.

As soon as the EU break from the British imperial “Euro” system, those nations, too, would be enabled to join that reorganization of the world system with the U.S.A., Russia, China, India, and others, in a change from a monetary system, to a world-wide network of respectively sovereign, national credit-systems constituted as a global, fixed-exchange-rate credit system . The result of that combination of developments would be a system, issuing new national credit-loans over a period of a half-century (and wiping the vast mass of “bad,” fictitious debt from the books), for rapidly rebuilding the world economy through major ventures in construction of urgently needed basic economic, public infrastructure among cooperating nations, freed from the evils of globalization, to return to the practice of being once more truly sovereign nation-state republics.

The difficulties of comprehension, especially in the West are chiefly products of the education system. . The key to the needed change from a hopelessly ruined monetary system, to the global array of a fixed-exchange rate set of credit systems is a matter of science, not mere opinion, especially in light of the peculiar character of the global crisis which confronts the largely “dumbed-down” and “mis-educated” world as a whole today. Teaching people WHAT to think, instead of HOW to think, produces idiots instead of smart people.

A new world is dawning. As the trans-Atlantic financial system crumbles and disintegrates, world power is shifting to Eurasia, to the Global South more broadly. Leaders of many nations increasingly trust China and Russia more than the “West.” The world effect of the NATO-Russia war being played out mostly in Ukraine is only catalyzing, accelerating these changes. The British saw the writing on the wall years ago, and have, with their U.S. friends, deployed Russia-gate and the anti-China campaign to maintain control. Although they cannot succeed in this, they may succeed in bringing about nuclear devastation.

The story continues in the next article, titled, “The Global Financial Tsunami Has Begun “