The Collapsing Machine-Tool Sector

The battered world physical economy, if it is to survive, must draw from and be energized by the machine-tool design sector. However, the machine-tool industry’s capability is being destroyed. This year, orders for this sector have fallen by more than half. This indicates a desperate situation for the world economy. It signals a deepening economic collapse in Japan, the EU and the US. But, it also indicates the permanent abandonment of any future. The machine-tool design principle is the well-spring of economic growth.

Economics starts with the capacity of man’s brains, or intellect, to make revolutionary validatable discoveries in science. In the scientific realm, these ideas are incorporated as designs for machine tools and other advanced machinery. Through this process, they are directly transmitted into the physical economy and the productive process, thus transforming and greatly increasing man’s mastery over nature and advancing civilization.

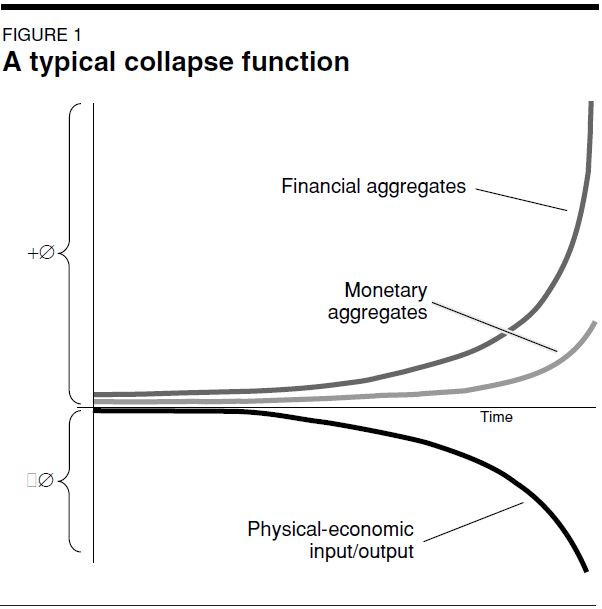

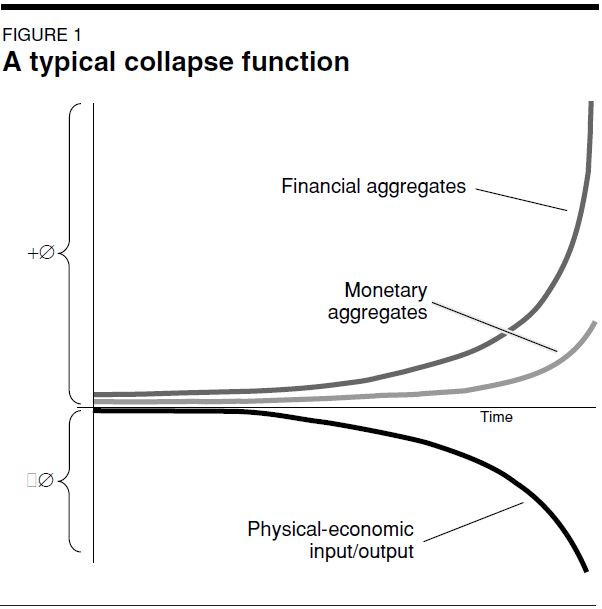

The loss of the machine-tool industry is due to a process represented as the Triple Curve collapse function, displayed in Figure 1. The speculative bubble is represented by the top curve, and the monetary aggregates (total money supply), which is attempting to hold up the bubble, is represented by the middle curve, sucking the life from the physical economy, which is the bottom curve, causing it to collapse. These are three curves, but one simultaneous function.

If mankind loses the machine-tool design principle, it will never have the chance to advance. Man will be thrust back into ruin and destruction, a world of half a billion semi-literate human beings roaming the earth – which is the explicit goal of the two families. The Rockefeller front man for this, currently, is Bill Gates, while the Rothschild’s front man is Prince Phillip. In order to reduce the world’s population through various means – one of which, currently is the corona virus program, there would be no better place than to start with decimating the machine-tool sector. That is why this sector has been deliberately targeted for destruction, globally. The machine-tool industry is collapsing at a dramatic rate. This collapse began in the mid-1990s, and has accelerated in the past decade.

What makes this a catastrophe for the world, is the fact that the machine-tool industry is a small industry, but a highly skilled, highly technologically developed industry. Machine tool shops employ between 10 and 200 people. World production of machine tools was only about $65 billion out of a world GDP of $75 trillion, or 0.1 %.

Let us look at just how concentrated the world’s machine-tool production is. Japan, Germany and the US produce some 45% of the world’s machine tools. Then comes Italy, Switzerland, China and Taiwan with some 40%; India at 3%; Latin America (largely Brazil) at 2%; South Korea at 4%; Russia at 3 %; and other countries at 2%. Africa, the Middle East and the rest of Asia have zero production of machine tools. The largest machine tool producing nations are Japan, Germany, United States, Italy, Switzerland, China, Taiwan, Britain, France, Spain, South Korea, Brazil, Malaysia and Russia. The world is starved for machine tools.

But the critical point is, that most of the population would not even appreciate what has just been proven about the devastation of this critical sector. They are focused on the stock market, social media and McDonalds. You say to most people, “What do you think of the fall of something upon which human life depends, machine tools?” The reply, “I don’t know much about it, and I don’t really care.” And that’s probably the biggest problem, because heads of state do not even understand that this is one of the most fundamental questions facing the human race, at least in terms of economic principles involved.

What Are Machine Tools?

Most people have not seen a machine tool. A machine tool is a machine that makes other machines. There are two types of machine tools; the metal-cutting machine tool and the metal-forming machine tool, or a stamping machine. Their distinction is based on their mode of action. The metal-cutting machine cuts metals, ceramics, or other materials; this can be done by boring, gear-cutting, turning, grinding, and so forth. Metal-forming machine tools stamp or form metal or other materials; their operations include stamping, forging, etc.

The introduction and advancement of machine tools, especially since the creation of the heat-powered machine, has created an increase of power and efficiency by man by as much as 100-fold.

An important feature of machine tools is that they build, not just industrial products, but other machines. From creative human discovery, machine tools build construction equipment, mining equipment, oil and gas drilling equipment, etc. The construction equipment, built with machine tools, in turn, is used to build dams, bridges, water mains. So the machine tool builds the construction equipment, which is utilized to build the physical infrastructure. By this process, physically, the machine tool design radiates out everywhere, throughout the economy.

The biggest bottleneck in the economic mobilization of the US during World War 2 (1939-1945) for war production was machine tools. Since machine tools build other machines, the US could not build anything without having machine tools first. US President FDR ordered the construction of new machine tool plants, and they operated on a 24/7 scale. Production of machine tools went from 38,000 in 1938 to 307,000 in 1944.

Here, we are talking about machines, not just restricted to machine tools in the narrowest sense, but to all advanced machines, including laser systems, power systems, rail systems, that incorporate this latest machine-tool design. In this way, each machine-tool design represents a transmission from the past of all the advanced ideas. It represents the transmission of all the important ideas of civilization, which are still alive, but now improved upon. Simultaneously, this process of generation of revolutionary ideas must shape the minds of members of the labor force, so that their ability, and associated skill level, are constantly rising. The labor force must have more powerful minds to master the machine-tool principle. Bring the two processes together, and now you have the advanced mind working with the advanced machine tool principle. This is the source of productivity. How do you go from the invisible world of the mind, into modifying the material and physical world? Where is that transmission point? This is it. This is the source of technological progress. Technological progress is not computers. It is not the Internet. It’s not the Information Age. That’s all nonsense! That high-tech stuff is not really high tech. This is the source of technology, the real source of technology. It’s the only source of technology, this entire conceptualized process. Man enhances the rate of growth of potential relative population density. The society that’s committed to this principle, that’s organized by this principle, is a society that moves and can move with the most advanced ideas.

The Rockefeller Empire specifically targeted the American machine tool industry for destruction. In the 1960s, it introduced the post-industrial society. In 1971, it manipulated Nixon into taking the US off the gold-reserve standard, and into adopting the floating exchange rate system. The oligarchy started building up the speculative bubble that sucked the physical economy dry. In 1979, Rockefeller asset Paul Volcker was made the Federal Reserve chairman, and applied a policy which he called “controlled disintegration “, which he and others developed at the New York Council on Foreign Relations, as part of a project, called Project 1980s. This produced in the 1970s, a series of 33 books. The Project 1980s book on monetary disorder, written in the 1970s, asserted that the economy would be put through oil shocks, energy cutoffs, interest rate hikes, and would plunge the economy into negative growth and disintegration, which the oligarchy hoped it could control—hence the term, “controlled disintegration.” In November 1978, speaking in Leeds, England, Volcker affirmed the policy, saying, “Controlled disintegration is a legitimate objective of the 1980s.” During the second week of October 1979, now installed as Fed chairman, Volcker raised interest rates into the stratosphere. By February 1980, the prime lending rate was 21.5%. The real physical economy, led by the machine-tool industry, buckled at the knees.

Farm equipment embodies the most advanced technology for man to alter nature on the farm, and it is disappearing. In shipbuilding, America went from building 77 commercial ships in 1975, to building none in certain years. Shipbuilding has the capability of building not only ships, but many other things—and now it’s nearly gone. So, the collapse of the machine-tool industry is the harbinger of, and accompanied by, the collapse of other critical industries, such as tractor production and the shipbuilding capability, which are leading features of the machine-tool design sector. Can the machine-tool design principle be saved, not only for America, but for the world? What does it mean if it’s not saved? If it is not saved, we don’t survive.

Where is the food and goods coming from if we aren’t producing it? Most countries are dependent on cheap international sources. Not just food, everything. What do you hear? Who needs farmers and workers? I can get what I need at Wal Mart. Compared to the 1960s, far less of the U.S. market basket is “Made in the U.S.A.” for consumer, producer or infrastructure inputs and outputs. You can’t change it. Globalization is here to stay. Just make sure it’s a level playing field. Make sure the Europeans aren’t cheating us. Make sure the Asians open their markets. . . . Look what this means about the landscape and infrastructure and inputs into production potential here in your country? It is winding down into breakdown. In the 1960s, there was a perspective that public policy must guarantee that housing be built at a rate to have enough around as the population needs grew. What do you hear today? There are too many people. Let the market decide who gets what. So, from industry, to power, water, consumption of the basic market basket, the economic potential productivity has declined, and the landscape reflects this.

We have reached the stage today, where we now have a pretense of an economy, but it’s called a “boom”! To underscore the insanity of this, think of just some obvious consequences of not building infrastructure, and allowing people to suffer and die around the world. The consequences of not making steel, not furthering agriculture, and most of all, not developing minds. Right now, one-third of the world’s population is infected with tuberculosis. It’s terrible in Africa; it’s 40% of the population in Asia. It’s coming back in the United States. And so are other diseases – the consequence of a failing health system – which is once again tied into the decline of the physical economy.

Concurrently, with the decline in machine-tool production CAPACITY, there has been a similar push to “dumb down” education standards in the West. After nearly 3 decades of this policy, most people intellectual capacity has diminished – they are unable to think for themselves. Add to this the explosion of the social media platforms, and the increasingly large numbers of people, globally, have become addicted to this. This is an ideal way for these 2 families to further “dumb down” the people.

And, finally, we come down to a very essential commodity – money. Here, we find the same reduction in quality and morals – except this process started in the 1970s. The financial system would have gone bust in the late 1990s, except it was allowed, not only to survive, but to grow. Currently, today in October 2020, nearly every major bank is the world is bankrupt. These, along with companies in a similar financial corner, are called “zombie banks, and zombie companies”.

Beginning in the early 1990s, the U.S. economy has become the envy of financial parasites all over the world. We have a derivatives market second to none, a stock market well beyond reason, debt levels that make the bankers drool, and enough jobs so that everyone can have two or three. The US Fed may not be able to walk on water, but it has certainly shown that the Fed can run right over the edge of the cliff without falling. However the Fed hasn’t done this all by itself. Plenty of help came from some of the brightest minds in the business, including the rocket scientists on Wall Street who figured out that you could sell enormous amounts of derivatives, issued by bankrupt banks, and backed by worth-less paper. Take Robert Merton and Myron Scholes, who won the Nobel Prize in Economics for nearly blowing up the global financial system. The pair won the prize in 1997 for developing “a new method to determine the value of derivatives.” What gobbledygook!

At the time they won the prize, Merton and Scholes were partners in Long-Term Capital Management, the big hedge fund that, using their formula, managed to turn millions of dollars of capital into billions of dollars in losses, on trillions of dollars in derivatives bets. It lost so much money that the Fed and the banks had to step in and bail it out, lest it default on its derivatives and set off a chain reaction of derivatives defaults which could have wiped out nearly every major bank the world. This prize-winning nonsense is, arguably, the worst betting system ever devised. That’s not so surprising, given the track record of the Royal Swedish Academy of Sciences (it’s in the Rothschild orbit), which awards the Nobel Prize. In the past, they’ve awarded the prize to defenders of slavery and feudalism. If they were honest, they’d revoke all the economics prizes they’ve awarded in the past. But the oligarchs of the Royal Academy are not trying to spread the truth, but to hide it.

Insanity of the Markets

We live in world gone nuts, where fiction is pretty strange, and truth is stranger still.

Take the following altruism, which you can find on the business pages of virtually any major newspaper: “In a free market, the true value of assets is accurately established by the actions of investors. If an asset is overvalued, investors will stay away, causing the price to drop; if an asset is undervalued, investors will buy, causing the price to rise. “The only problem with that statement is that none of it is true.

Free Markets? What free market? It doesn’t exist. The markets are largely the creation of the international financial oligarchy – the 2 families, which uses them as a battering ram against the nation state, and a way to pick people’s pockets. These two networks routinely organize raids on nations as a way of bailing out their banks – or an act of geopolitical, financial and economic warfare. All of the financial crisis of the past two decades – the 1997 Asian Crash, the 1998 LTCM and Russian default crisis, the March 2000 “dot-com” crash, the 2008 financial crash, and many other smaller incidents, have served the same purpose. It is insider trading that would make most people green with envy.

Free? Only in the sense that the oligarchs are free to steal.

Investors…What investors? Virtually all what is called investing today is really speculation, bets on the movement of stocks, bonds and currencies. Investors are people who put money into an enterprise in order to increase its usefulness to society. But the markets today are a giant casino, where gamblers place bets that some things will rise, and others will fall. And since this casino is rigged, the advantage goes to the insiders. So you can call them thieves and suckers, but not investors.

True value of assets? You’ve got to be kidding. The real economy of the US, the physical economy – measured in terms of physical inputs and outputs per capita, per household, and per square kilometer, has fallen by some 65% since the late 1960s. What holds true for the US, holds true for most western economies. The Dow Jones was hovering around 1,000 back then, which means it should be – according to economic fundamentals – at about 350 points today. Of course, this doesn’t take into account inflation, the looting of foreign economies, and the cannibalization of what was once the most powerful industrial economy in history. But still, anyone who claims that today’s bubble reflects the “true value of assets“is being foolish – at best.

Many “economists “in the late 1990s and early 2000s were claiming that the Internet was more important to the economy than the Central Banks. In a sense, that is true, since at least some aspects of the Internet are useful. But the idea that the Information Age is the natural successor to the Industrial Age is dangerously wrong.

That is especially clear in the yuppie fantasy of the day – “day traders”, and “on-line investing”. Many individuals have jumped into these activities, which represents an extension of Wall Street. Today, everybody is getting into the act, from kids to grandparents. There are even summer camps, where kids are taught how to play the markets. Suckers may not be born every minute, but they are certainly being trained.

In a properly functioning economy, the most valuable industries are those which make things, which transform less valuable inputs into more valuable outputs, thereby creating wealth and increasing the productivity of society as a whole. That is not exactly the way it works today.

The most valuable companies in the world today are tech and social media companies. Even with the recent orchestrated declines, the Internet stocks are very high. One of the linchpins of the assertion that the US economy is fundamentally sound“, is the presumption that rises in asset values create wealth. There is a small problem with this rosy picture – stocks do not create wealth.

That is, if the value of all stocks listed on the stock exchanges was $15 trillion yesterday, and rises to $15.1 trillion today, then $100 billion of wealth has been created. By this standard, the U.S. stock markets are amazing wealth-creation machines. There’s a small problem with this rosy picture, however. Stocks do not create wealth.

Now we’re getting to the heart of the matter: a bubble has formed in Wall Street’s brain. The idea that reality is determined by perceptions is one of the more pervasive idiocies of our time. The truth is that a plant which produces motor vehicles has value no matter what Wall Street thinks, and regardless of whether or not it makes a profit, because the production of motor vehicles is inherently useful. The plant can lose money and still be productive, in real economic terms. It’s the effect on the economy, not the investors, which counts. A steel plant, even the most outmoded, inefficient plant in the world, has more value than Facebook, because it produces steel, which is necessary for human survival. We can live without Facebook—at least most of us—but we can’t live without steel.

Wall Street lives by a simple philosophy: If it makes money for us, it’s good; if it doesn’t, it’s bad.

In such a warped world view, full employment is bad, because it increases the chances that companies will have to pay higher wages to attract and keep employees; for Wall Street, having a big pool of unemployed workers is good, since anyone who dares to demand a decent wage or decent working conditions can be easily replaced. Therefore, when employment goes up, the market goes down, and when employment goes down, the market goes up.

The same thing occurs when the production indices—which should never be confused with actual production—go up. Rising production increases the chances that the economy will “overheat” from growing so fast, thereby increasing the likelihood that the Fed will raise interest rates to cool things off.

All asset values rest on the perception of the future. A car factory is a pile of junk if there are no buyers for its products. A motor vehicle assembly plant is a pile of junk if no participants in a market economy perceive it capable of turning out cars and trucks of use to consumers and profit to producers.

Derivatives

The growth of the derivatives market is astonishing. According to the International Monetary Fund (IMF), world trade in goods totalled $15 trillion in 2018, and gross world product was $81 trillion, compared to what we estimate was some $1,200 trillion in derivatives bets. Overall there are some $1,500 trillion in financial claims outstanding, with more than $4 trillion in financial bets placed every business day. That puts annual financial turnover—the sum of all these bets—at over $1 quadrillion ($1,000 trillion)—some $250- 400 in turnover for every dollar of trade in goods. The world derivatives figure is our own estimate. It’s not entirely clear that anyone knows the actual number, and if they do, they’re trying to keep it a secret. All the official figures are designed to hide, rather than reveal, the truth. The bankers call this “transparency.” What are they doing with these derivatives? Hiding losses; rolling over unpayable debt. Look at Credit Suisse, which was caught red-handed in Japan selling Japanese companies derivatives expressly designed to hide losses. One former Morgan Stanley derivatives salesman metaphorically described the process this way:

“You combine $90 worth of gold and $10 worth of lead into a bar. You then sell half of the bar—the half which contains all the gold—for $90. Since you paid $100 for the whole bar, and $50 for each half of the bar, you book a $40 profit. After all, you paid $50 for that half-kilo and sold it for $90, so you made $40, right? Of course, you’re left with a half kilo of nearly worthless lead, which you’re carrying on your books as being worth $50, but that can be hidden. What counts is that you made a big profit, up front. At least, you claim you did. “And these hidden losses are rolled over. That type of fraud, applied to paper assets, is what the derivatives market is all about. This is the “traditional speculation” which Wall Street and the City of London defend.

Deeper in Debt

In the United States, the great economic boom of the past 3 decades has been accomplished by going $3 in debt for every $1 increase in GDP. But only one-third of GDP represents productivity and two-thirds represents overhead, and virtually all of the growth over the last 2 decades has been in the overhead sector. We’ve actually been increasing the debt while shrinking the productive sector. This process of going ever deeper in debt, while destroying our ability to pay that debt, is what economists call sound economic fundamentals.

The decline in the productive sector has triggered a decline in real wages for most people, who have been forced to go deeper and deeper into debt to make up for shortfalls in income. When debt rises and real income falls, bankruptcy can’t be far behind, and it hasn’t been.

This is truly virtual reality: Those things which are actually good for society—such as a rising standard of living and rising productivity—are considered bad, and those things which are bad for society—like a declining standard of living and falling productivity—are considered good. All that counts to the fleas is their money – to hell with the dog. It is, in a word, psychotic. Sooner or later, such a system must inevitably collapse, and we have now reached that point—we have entered the zone of instability which marks the end of the present system.

Look at the pace of mergers over the past 3 decades, in the financial world, where the big banks are in a mad dash to become too big to fail. After all, the big banks don’t go bankrupt, they merge (in the trade, it’s called mergers and acquisitions, or M&A for short. All over the world, the number of banks is shrinking rapidly, as the drunks lean against each other to keep from falling down.

In the United States, the number of banks has dropped by some 40% since the mid 1980s, but even that doesn’t tell the whole story: The big banks are swallowing each other at an incredible rate, usually in shotgun marriages arranged by the Fed.

As the bubble grew, a whole group of financial institutions grew up with it, institutions of seemingly great power. Now that the bubble is dying, those same institutions are now threatened with extinction, and are fighting for their lives. They won’t make it. These seemingly all-powerful giants are crumbling before our very eyes.

The more clever among the oligarchs have been preparing for the crash by buying up control over the necessities of life, so that after the crash—after all the paper wealth has evaporated and all the suckers have been ruined—they can control what is left of the world. That is the reason for the bloody wars along zones that are rich in mineral resources and oil, and the reason for the surge in mergers among industrial companies in recent years over that time period.

There are those among the oligarchy who, after all, under-stand that those who control the raw materials, the strategic minerals, the precious metals, the energy and water supplies, and the means of production of those items, control the destiny of mankind. After the crash, they plan to use their control over these necessities of life to consolidate their control over humanity.

This is what is behind the escalating pace of mergers in oil, food, telecommunications, pharmaceuticals, chemicals, aluminum, copper, and energy and water utilities.

The old system is gone, finished. The question is: What will replace it? A return to the days of the empire? Or a leap into a new Renaissance? To repeat the errors of the past is to doom the world to feudalism and a new Dark Age. Better that we learn from the best lessons of history, and build that new

Renaissance. Let us choose reality over psychosis.

Let me summarize , in brief, the above. Take an example of a dog (that’s the world INDUSTRIAL ECONOMY), and a flea (that’s WALL STREET & its derivative games). The fleas trade the blood of the flea, and suck it dry. A point will be reached wherein the dog dies – due to the blood being drained out of it by the fleas. If the dog dies, then so do the fleas. BUT, the fleas couldn’t care less. They are interested in the here and now, salivating over their profits and bonuses. That is the state of the world today. All of these failed policies, and lying to cover up their losses has brought the world to the current state that we find ourselves in today. To hold onto their declining global power, the 2 families have combined to advance their agenda in bringing about a system where a single governing authority rules the world – a global police state – and all that this means for humanity.

One thing for sure that I have noticed in the world of geopolitics is this mantra: FOLLOW THE MONEY. That gets one the answers fast. That is the only valid explanation as to what is happening now; it’s all about the money. It always has been this way since the dawn of mankind. To clarify the message of this article, we have to go back in time a few decades. With the background in place, we will be in a position to better understand current events.

Background

By the end of World War 2, in 1945, the US had emerged a winner, and thus began the American Century. Eurasia was a burnt out landscape, and all of the economic rivals of Wall Street were defeated and impoverished. After the war, the US slid into recession, but was saved by the outbreak of the Korean War a few years later. Recession hit again a few years after the end of the Korean War. Then, in 1963, Wall Street exercised the Vietnam Option, financed by borrowings, which eventually led the US to close the gold-dollar convertibility at the US Federal Reserve in August 1971; otherwise the US would have run out of gold reserves.

The resulting 40% fall in the value of the dollar over the next two years prompted David Rockefeller and Henry Kissinger to bring about the October 1973 War between Israel and the Arabs. This war resulted in a 400% increase in the oil price. The main beneficiaries of this were the major banks and oil companies of the two families.

The US dollar dropped in value because nobody wanted the dollar, but, by end 1973, the dollar was everyone’s favorite. The reason for this? Oil was priced ONLY in US dollars. Since oil imports had to be paid in dollars, the demand for dollars shot up, and so did its value. Thus, the Petro-Dollar was born. The petro-dollar was to bring misery upon many nations and its citizens- from financial and economic wars to invasions and coups.

With the petro dollar at center stage of US policy, it was now time for New York and London to re-order the global political, economic and financial landscape. Which they did over the next 30 years. Here, we will focus on the financial and economic angles of this. We will discuss this over three time blocks.

1975-1991

The following events are key to note. In 1980, the Federal Reserve increased the prime rate to 20%, crippling the global economy. This led to trade barriers coming down, and it increased global trade, thus ushering in “globalization” of the world economic and financial markets. It also brought about the Third World debt crisis. This period also saw the birth of the derivatives markets on Wall Street. This led to the 1987 stock market crash. Then came the 2nd Gulf War, involving western powers fighting Iraq. This was at the same time that the Soviet Union collapsed. At this point, Wall Street turned on its vacuum machine, which was to sustain the solvency of Wall Street’s financial sector.

What do we mean by the vacuum machine? A vacuum machine is used to extract the dirt from a carpet. Wall Street’s vacuum machine was used to extract and loot money from various targeted nations. The 2nd Gulf War (1991) cost the US nothing. Its allies paid for the cost of the entire war. In fact, the US made a profit of $15 billion.

Then, with the collapse of the Soviet Union, a free for all ensued till 2000, when Vladimir Putin became Russia’s leader. During these nine years, several hundred billion dollars, in gold, cash, and raw materials were “vacuumed” out of Russia, and into Wall Street banks. These two factors bought more breathing time for its banks.

Between 1997 and 1999, the vacuum machine was used in Asia, Russia (again) and Brazil. There goes another several tens of billions into the coffers of Wall Street. In 1998, Wall Street hedge fund, LTCM, suffered massive losses on its derivative bets, and nearly managed to take down the global banking system. By March 2000, it was the turn of the American people, when the crazy “dot-com” bubble burst. Billions were lost by the investing public.

Ideological conflict came to an end with the collapse of the Soviet Union, in 1991. From now on, the US power elite, grouped around the Rockefeller family, began a very silent economic war on its potential rivals, and to make sure that they don’t unite against the US in the entirety of Eurasia. To a great extent, this strategy was successful, until the five largest Asian nations grouped together to form the Shanghai 5, which would become the Shanghai Co-operating Organisation. This was a serious threat to US plans to dominate Eurasia, and so a few months later, the invasion of Afghanistan was launched, as a means to delay, and stop, the formation of a potential rival block.

Then in March 2003, the US invaded Iraq in a regime change operation. This was caused by Saddam Hussein’s move, in September 2000, (under advisement from the Rothschilds) to sell Iraq’s oil for Euros, instead of dollars. This is a policy that New York would not allow. After the fall of Iraq, the policy changed when Iraq began selling its oil for dollars in June 2003. About $16-40 billion was electronically hacked from the Iraq Central Bank, within a week of US forces entering Baghdad.

The Rockefellers knew well who instigated Saddam Hussein – a story we will leave for another article. The CIA was well informed of these talks between the French Rothschilds and Saddam Hussein. To protect themselves, a financial war using derivatives was launched against a key Rothschild bank, JP Morgan, resulting in its bankruptcy and take over by Rockefeller’s Chase Manhattan Bank in October 2000. With this move, the Rockefellers took ownership of JP Morgan’s 17% stake in the Federal Reserve Bank of New York – the key US central bank. The Rockefellers now owned 52 % of the US Federal Reserve.

A similar punishment was meted out to Muammar Ghaddafi when he was toppled from power as Libya’s leader in 2011. The same looting thing happened with Libya. Western banks stole Libyan funds and investments that were lodged with them. All of Libya’s Central Bank gold was stolen as well.

Beginning in early 2002, the sub-prime mortgage scam was launched, and in 2008, it all came crashing down. The vacuum machine was at work, again. This time, people, companies, and governments all took losses, especially the EU governments who had to pump 100s of billions into the Rothschild banks in Europe. This marks the beginning of the end of the Euro. What is the Rockefeller family motto? “COMPETITION IS A SIN!”

When LTCM went bust in September 1998, it was at this point, that Wall Street began to commit fraud on a large scale, and it was well hidden from the public. It was the beginning of what came to be known as FAKE NEWS! Many banks, suffering losses, began to cook their books. This disease infected other corporations, such as Enron, and many others. The rot was already in, and it would spread throughout corporate America, and on Wall Street as well, over the ensuing two decades. This rot would eventually enter the world of the MSM and social media. Many people have tuned out of the world of the MSM, and its fake news narratives.

In the meantime, the industrial base of western economies was shrinking. Why produce when you can import the same products from China, at far lower costs. This, in turn, led to an under-investment in infrastructure and higher education. The result? Operating costs began to mount, while profit margins began to decline. If you are not upgrading your industrial base and moving up the technological chain, to add a higher value to your products, over time, your profit margins are bound to decline.

China went in the opposite direction. Starting with low value goods, its production of higher value goods increased, with a corresponding increase in the number of universities specializing in advance technologies, etc. The result is an increasing rate of return.

Western companies and banks resorted to “cooking the books” to hide mounting losses and disappearing profit. Remember the story of the dog and the fleas. The dog was dying, and the fleas were in a panic mode. IN 1960, the industrial and commercial sectors of western economies were the dominating factor in the business world. Two decades later, it was finance and Wall Street that became the dominating factor in the business world.

An under-investment in infrastructure, education, and advanced technologies has brought western economies to its knees. There is only so much of “cooking the books” these companies and banks could do. The use by Wall Street of the looting (vacuum machine) strategy could work only for a limited time, while its economic rivals began to get stronger, and with an increasing military might to defend its hard won gains against the thieves of Wall Street and the City of London.

The banks were so broke, and nearly all were hiding losses from its derivatives trading operations, in addition to its loan losses, that, in order to save the banking system of the two families, a desperate move was launched by the Fed and the ECB. This policy was called quantity easing, or QE. What this policy did was that the 2 central banks bought up the loan and derivative losses from the banks. Over the past 12 years, the figures run into several hundred billion dollars and Euros. Currently, the ECB is purchasing bad debts at the rate of 20-30 billion Euros a month. A similar policy is being done by the US Fed. This policy cannot continue. It’s like pouring water into hell in order to extinguish its fire. Not sustainable.

Please look, reflect, ponder and study this figure again – the Triple Curve function.

The bottom line (the dog) shows a fall in investment in the physical economy, while the top line (the fleas) shows an increase in financial instruments, etc. The fleas are desperate. The fleas are looking for additional income streams to survive, because, right now, the dog is beyond saving. And that, folks is the REAL REASON behind all these current schemes and plots by these 2 networks of power, which includes the corona virus – and what follows.

Not only that, its economic rivals – Russia, China , Iran and the EU (all of whom are located in Eurasia) are trying very hard to bring the world to its senses, and to pursue economic and financial policies that best serve their people, and the world as a whole. London and New York are working to torpedo this. China and Russia are increasing investments in both hard and soft (education, health) infrastructure. The Western economies are not – due to a lack of funds and dystopian ideas.

Within a year of the 2008 financial crash, the Rockefeller Foundation worked on a new project, and published this report, the 2010 Rockefeller Report. It was just in time. Subsequent events in the world of geopolitics and international finance brought home to the Rockefeller Empire that if it did not act fast, then there was a great chance that their decline in power will accelerate to the point of no return.

Within 2 years, in 2012, Obama was instructed to “pivot to China”. The new enemy of Wall Street was decided. It was China.

In Part 2 of this series we will discuss the colossal assault on humanity that the 2 families have launched. The corona virus issue is just the beginning of a series of diabolical steps to bring this about.

Ty for your powerful insights