Europe in the 17th and 18th century was at the beginning of the Industrial Revolution. Old forms and customs were slowly dying out. There were no large unified political bodies, east of France, with the exception of Switzerland and Russia. The Jews as such, were treated with dislike and contempt, and many obstacles were placed on them in regard to trade. The enterprising ones were nomadic hawkers trading in goods from one town to another. To understand the mentality of the Rothschild family, it is wise to study the early days of the family. Not many families have had this kind of staying power, with the exception of the Rockefellers in the US.

Our story starts with a certain Amschel Moses Bauer. He lived in a house in the Jewish Ghetto of Frankfurt. The distinguishing sign of this house (in lieu of a physical address) was a red shield – (in German “roth schild”). Jews were known by a variety of names, some by their places of residence, and so, the sobriquet, “Rothschilds” stuck. This also explains the origins and the significance of the color red in communism. This ‘communism’ was given birth to, produced and directed by the Austrian branch in the 1830s.

The family dealt with fabrics mainly, and money-changing on the side, as Germany at this time was a bewildering patchwork of 235 principalities, each of which issued its own coinage. Great commercial centers such as Frankfurt had a need for dealers who knew the coin business. The family attained to great wealth in a very short time-frame, between 1805 and 1830. They went from nothing to the world’s richest family in the space of 25 years. There were 3 distinct phases to this. We shall call them ‘stepping-stones’. And we will discuss them individually.

Stepping Stone 1- Prince Willam of Hesse-Kasel

On February 23, 1744, a son was born, named Mayer Amschel. At age 11, he lost his parents, and was sent to old friends of his father, the Oppenheims of Hanover, bankers. In the next 6 years, Mayer Amschel saw and studied many wealthy and powerful men. One craze that affected many of them was collecting old curios, coins, stamps, etc. Young Mayer had already developed an interest in old coins.

At Hanover, he became friends with General von Estorff, a keen collector and an adviser to Prince William, heir to the Principality of Hesse-Kasel. In the 1760s, he began supplying coins to the young price, always at bargain prices, sometimes at less than cost. He was more interested in building relationships than immediate profits. If he was successful, he would become Court Jew to the wealthiest ruler in Europe.

Prince William’s forebears had grown rich on war, not waging it, but by supplying soldiers. From 1618 onward, there was scarcely a conflict in Europe or overseas in which Hessian mercenaries were not involved. This “rent-a mercenary” brought a fortune to the coffers of the Prince of Hesse-Kasel. William of Hanau was a grandson of George 11 of England, a cousin of George 3rd, a nephew of the King of Denmark, and brother-in-law of the King of Sweden. Obviously his relatives were doing well. What made them even more important to William – and what gave a signal part in Mayer Amschel Rothschild’s story – was the fact that just about the entire collection of majesty’s owed money to little Hanau. The profits from the trade in death had made Hanau the richest country in Europe, with huge surpluses which were invested or loaned to governments at high interest rates. He thus became the richest ruler in Europe, and its first billionaire.

By the 1780s, Mayer used to distribute catalogues containing his stock of coins, medals, prints, etc., to the nobles around Frankfurt. Patiently he built up vital contacts with the elite of Germany, including the Thurn and Taxis family.

This family filled a curious, but vital role in Central Europe. They operated the only official postal system in the Holy Roman Empire. From their offices in Frankfurt, they had organized, since 1389, a series of mounted couriers who travelled over bad and robber-infested roads of Germany and Austria. They duties to the Emperor often went beyond collection and delivery;- they included opening, copying and resealing any letters whose contents might be of interest to Vienna-the capital city.

Services to the House of Thurn and Taxis brought Mayer into distant contact with the imperial court. More importantly, they brought home to him the importance of an efficient communications system. It was a vital lesson – the lesson that information is power, and this power creates wealth. Certainly, Mayer took it to heart, for when a few years later, he and his sons set about building up financial operations on an international scale, and their success owed everything to their incomparable courier service. They prospered because they received news of market trends, commodity prices and major political news, before their rivals did. In 1770, Amschel married Gutele, and she bore him 5 sons and 5 daughters.

The start was one Carl Buderus-the finance minister of Prince William. Through the rare coins he got as holiday gifts, Buderus came to like the Jew. Through Buderus, Mayer was given a few of Prince William’s London drafts for cashing. Rothschild had, at last, broken into state banking. In 1785, Prince William became the ruler of his country after his father’s death. He then moved to Frankfurt. Soon, invisible bonds began to connect the Rothschild house with William’s castle. Few knew of this tie while it was being forged.

No trumpets announced the Rothschild’s ascent to world power. The promise of the family’s conquest lay in their very stealth of their crouch and the silence of their leap. Their aim was so high – compared to it, their position was so low. Their first foothold was so precarious, and their resources so feeble that any alert rival could have destroyed them with a single stroke. Yet, the three points by which Mayers house was to overwhelm a continent and the world, were already doing their work in miniature:-

- The Rothschild clientele consisted, to a calculated degree, of the elite of Germany- and never mind if their high positions brought low profits;

- Mayer courted Prince William with low prices, which earned Mayer the increasingly crucial cooperation of Buderus- who exerted influence over the greatest money hoard in Europe;

- Mayer had sons

Here was, and is, the simplest, most important power instrument of all- to have sons. In essence, the dream in Mayer’s soul was dynastic. All the connection-making, the story-telling and charming was dynastic investment. Since he had sons, he became a mover of mountains. As long as Mayer lived alone with his wife, he was just another Jew. The sons became his armies.

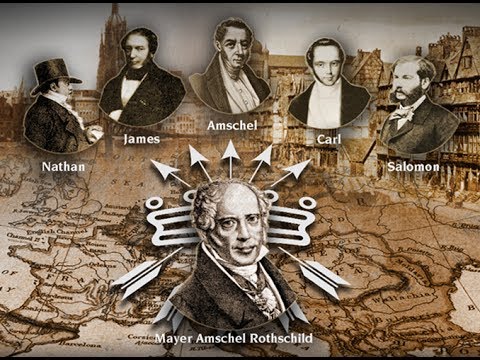

First came Amschel- future treasurer of the German Confederation; then Saloman, who in the end achieved the high position in Vienna that remained Prince Williams’s perpetual dream; then Nathan, who rose to more power than any other man in England; then Kalmann, who wound the Italian peninsula around his hand; and finally Jacob, who was to lord it in France for 60 years.

In the beginning these 5 boys ran errands, manned counters, and added figures. They became alive at the market place, and were fiendish calculators. They came running into the house with some goods which was bought cheap and sold it at a high profit with astounding pressure and speed, a few hours later. Success itched in their bones. Yet their gentler father was needed to release it. He put forward a pleasant face at a time when the skill at pleasing was more useful than the ability to negotiate. Here, the father put the subtle touches on the sledgehammer schemes of his boys. A precedent established itself to pattern the future: In the House of Rothschild, brilliance may be individual, but accomplishment is joint. Brothers and cousins complement each other, and so do generations.

The first scheme, using Prince William’s banking business consisted of a complex and ingenious putting together of two and two. On the one hand, there was the Rothschild cotton fabrics business, paid for with money going to English textile merchants in Manchester. On the other hand Prince William was receiving money from England for his mercenary army- in the form of bank drafts. On the third hand, (Rothschild reasoning is usually multi-angled), those English textile merchants could be paid directly with William’s London drafts – and the discount fees pocketed both ways – if only William could give Mayer such discount business again and in larger quantities.

“Now” meant 1787, two years before the outbreak of the French Revolution. The court took its time. At last, in 1789, drafts worth 800 sterling arrived at the Rothschilds house. It was first a trickle that became steady and strong and largely profitable. But this income did not satisfy the dynamic new impatience at the Red Shield. What was draft discounting compared to the handling of bonds-government loans, in which William invested much of his huge income? These bonds were handled by several Christian bankers in Frankfurt. And there were quarrels between them and Buderus.

Suddenly the Rothschild boys stood hat in hand before the big bankers. In their funny Jew Street German, they said “Please, let us be the intermediary between you, the dignified bankers, and difficult William”. The bankers looked amused at these eager, uncouth apparitions. Established Frankfurt agreed. It paid these ghetto louts a small commission for being its messengers and William’s butts. Established Frankfurt was served well. William liked the way the youths jumped to it, and his finance minister, Buderus, became a secret partner with the Rothschilds.

Soon Saloman was an almost daily fixture at the castle, incorporating Rothschild into the financial apparatus of the court. Soon, Amschel was arranging and participating in some of William’s mortgage business. Soon, Nathan, who had quarreled with an English salesman over textile prices, found himself in Manchester. Nathan began sending directly discounted textiles through the French Revolution to the Rothschild store in Frankfurt, just as prices started to skyrocket.

Almost by accident, the family had taken its first steps towards forming an international network. Soon, the Red Shield team fanned out in all directions. In every stage-coach, a young round-eyed Rothschild sat, portfolio wedged under his arms, eyes avid bit impenetrable. And Mayer himself followed, soothing where there had been too much sharpness, conciliating and smiling as consummately as his sons had argued and promoted.

Soon, the Jewish community in Frankfurt took a surprised look at the phenomenon in their midst. For 20 years Mayer’s tax assessment had been the same; 20,000 guldens a year. Abruptly in 1795 the amount was doubled. The next year his official worth reached 15,000 guldens, the highest possible fiscal category in the ghetto. Soon, Mayer executed in total secrecy his first important loan involving a foreign government.

Someone once said that the wealth of the Rothschilds consists of the bankruptcy of nations. In 1804, the entire treasury of Denmark consisted of a deficit. Mayer, kept current by Buderus, knew the facts well. He knew that William suffered from an unbearable surplus. William was prepared to help Denmark- particularly since a kingdom makes pretty good collateral. But the problem was the Danish King was William’s uncle. It’s always bad to show your poor relatives how rich you are. Loans within the family can easily degenerate into gifts. The thing to do, in this case, was to make the loan incognito. Not through the established bankers identified with William. The Rothschilds were chosen – no one knew about them. The loan went through the Rothschilds. The big bankers eventually found out, and it created a big uproar in Christian Frankfurt. Allegations of Jewish cunning were levelled against the Rothschilds. In the end the shouting did make them hoarse. The family was simply too useful to William. Buderus said so, and the Prince knew it for the truth. Their energy, their funny accents, their ubiquity had become indispensable.

Their last quality was decisive. They were everywhere. One father had five sons, and they had become a preternatural force that devoured distance, limits, precedence and frontiers. Old Mayer now gave this new force formal status. In 1800 he formed a partnership with his sons. He established rules which became pillars of dynastic constitution. All key posts in the firm were manned by family members, and not hired hands. To this day, with rare exceptions, only the family members are partners or owners of all the key Rothschild banks, and since they are privately owned, no balance sheets are published, and their financial privacy is guaranteed. No information is published on any Rothschild business, despite owning and controlling some f the largest enterprises in the world. Family and business were welded into one formidable machine. Daily, the Rothschilds exerted smoother and greater power. They still lived in Jew Street, but their commercial quarters expanded to offices and a warehouse outside the ghetto walls. In the basement of the house, the gold mounted, together with packets of securities. Above all, the Rothschild position with Prince William was very solid. They were at the point of becoming chief bankers to the world’s richest monarch-Prince William.

Just when Mayer’s dreams almost became substance by 1806, Napoleon seemed to sweep it away. He was sweeping away everything else. William was sitting on the fence between Napoleon and the British-Austrian Alliance. Napoleon did not like fence-sitters. When his Grand Army came crashing down on Austria in October 1806, it came crashing down on Hesse as well. It appeared to be all over. Frankfurt suffered occupation. The lines of international commerce were shattered. Nathan looked marooned in England. On November 1, William fled into exile. The next day, French troops flooded into his castle, following Napoleon’s orders, which read: “My object is to remove the House of Hesse-Kasel from rulership, and to strike it out of the list of Powers”.

Thus, Europe’s mightiest man decreed erasure of the rock on which the new Rothschild firm had built. Yet, curiously, the bustle did not diminish at the house of the Red Shield. Dust whirled behind the carriages in which these young Rothschild boys sat. They saw neither peace nor war. They saw none of the things that blinded the world. They saw only stepping stones. Prince William had been one. Napoleon would be the next.

Napoleon was an outstanding military genius. After toppling the French King in the 1789 Revolution, the Jewish financiers and the Illuminati Council put their own people in the new government. In 1800 they established the Bank of France, thus gaining control of France’s economic destiny, and made Napoleon the Emperor of France. By 1805, a split happened between the bankers and Napoleon. From 1806, Napoleon went his own way, and the bankers worked tirelessly to bring Napoleon down, over the next decade. The bankers got Britain and Austria to challenge Napoleon.

In November 1806, Prince William fled Frankfurt to live in Denmark. Most of his wealth was beyond Napoleon’s police. Documents and some jewelry were hidden at the Rothschilds house. William had debts maturing and owing to him in all parts of Europe. In addition, British investments paid him dividends of $3000 a month, equal to $3 million in today’s value. And now he sat in Denmark exiled, cut off from the management of his business. For the management of much of William’s fortune, Buderus chose Mayer Rothschild.

Napoleon declared that William’s treasury was now belonging to the French government. It thoroughly canvassed all the nobility of Germany who owed William. It tried every device from threats to rebates and easy terms, to direct the amounts due, into Napoleons purse. To no avail. Mayer’s boys skimmed across Europe in their coaches and scooped up the debts. During those years in Williams employ, the boys had acquired connections and knowledge. They were impossible to stop or hold off. Napoleon’s finance ministry could not cope with the family.

The care and feeding of William became Mayer’s province. Not an easy job, because William kept complaining about the fact that the Rothschild boys were collecting vast sums of William’s debts, but only a trickle reached William, and no precise accounting whatsoever.

Meanwhile, it just happened that Nathan in London found himself in possession of a fortune in Williams’s funds. He purchased textiles and foodstuff-all of which Napoleon had declared as contraband on the Continent. By this time, Napoleon had banned the import of British goods into Europe. The dislocation of trade forced Nathan to close down his textile business in Manchester. He moved to London to concentrate all his energy on breaking Napoleon’s blockade of British goods. He hired a group of daring captains, mostly working out of the Kent coast. With their help, and that of the family’s invaluable information network, he sent cargo after cargo across the North Sea to small unguarded harbors where his agents waited to offload them and convey them rapidly inland.

Many of these ship captains remained in the service of the family. Many of their descendant have risen to become “captains-and kings” in various Rothschild businesses in Britain, even up till this day.

And then fresh goods happened to materialize on starved store shelves everywhere; in Germany, Scandinavia, France, and other areas. Cotton, coffee, indigo, sugar – there it was, at last, at famine prices gladly paid. Who cared if somebody made a fortune? Napoleon’s one-track minded police cared. After a while they became obsessed with the idea that there was a connection between such widely separated things as contraband, Prince William’s debts, and old Mayer of Jew street. Buderus was known to be the lynchpin of William’s covert operations, and he was frequently brought in for questioning.

On September 27, 1810, Mayer sent out a notice announcing a change in the name of the business to N.M. Rothschild & Sons. On October 30, 1810, two French infantry regiments raided the Frankfurt warehouses belonging to the Red Shield. They found nothing, for a better reason than usual. The Rothschild’s hands were really clean. Towards the end of 1810, they got out of smuggling, and the nerve center of the Rothschild’s operations had shifted from Frankfurt to London. The nature of the family business was changing from commerce to finance, and that meant working closely with Mayer’s business associates and clients.

Stepping Stone 1 was Prince William. Stepping Stone 2 was to be Napoleon.

All the English merchant bankers started as traders with goods and credit everywhere, eased naturally into trading-cum financing, and ended up as the first great international financiers of modern times. Amongst these, Nathan ranks first. Through him the family stopped trading in goods, and switched to the ultimate commodity-money. From 1810 on, to this very day, the family would deal primarily in money, eventually evolving to the control and creation of money via their instrument of control – the central banks of the world.

The transformation which came over the family in a few brief years was quite staggering. It was unique in the annals of commercial history. In 1810, Nathan was one amongst several London merchants. By 1815, he had become the principal financier to the British government, the man behind Wellington’s successful Spanish campaign, the man who provided the money which made possible the greatest of British victories at Waterloo. The gulf between a general merchant, and an official banker to His Majesty’s Government was immense – and yet Nathan bridged it in a little more than five years.

The action of these 5 years falls into 2 stages- each a complex series of dealings shrouded in secrecy. Act 1 centers upon the funds which William placed in the Rothschild hands for investment. The Princes’ money was the rock on which the family fortune was built, as Kalmann acknowledged in 1814: “The Prince made our fortune. If Nathan had not had William’s money in hand he would have got nowhere”.

Nathan sized up the opening provided by Napoleon, that unruly but, on the whole, useful market factor. In a secret letter he sent to Frankfurt, Nathan proposed the following, the gist of which is as follows : “ Napoleon had swallowed up nearly all the countries in which Prince William had once put his idle millions out to pasture- only England was left to loan to. England, that rock against Napoleon. And Consols-English government bonds- the top government bonds in Europe. Since William had invested in the past in Consols, so why not do it again, and this time, through the good offices of N.M. Rothschilds & Sons in London.”? Mayer and Buderus took this proposal to William, who was reluctant, citing past delays with the boys. It was only when Nathan was willing to waive his normal fee, and charge a tiny fee of one-eight of 1 percent, that William’s greed won the day. William agreed to this deal.

Between November 1809 and December 1810, Nathan received 550,000 pounds to be used to buy consols for William. It was, and is a huge sum of money, equivalent to some $70 million in today’s value. It dwarfed all of William’s loans and dividends which had so far passed through Rothschild hands.

The moment it touched Nathan, every farthing became a shilling, every shilling became a pound. Nathan struck with such bulls-eye intuition, so powerfully, so fast, and at the same time so discretely that no records have survived. Nathan invested all the money from Prince William in his own name, as the enmity between William and Napoleon precluded William becoming identified with such an investment. With stunning precision and speed, Nathan speculated on the price of gold bullion, earning weekly returns of 10%, on the gold flows between London and the Continent, and back. Daily he leapt in and out of the market, never early or too late.

After a while, William began to fidget as so little news was forwarded to him from London and not a single bond certificate. Mayer went to work, blaming all the difficulties of communications that Napoleon had placed between London and William. This calmed William down. But he suspected that Nathan was using this capital for his own purposes, and using the war as an excuse for delaying the submission of accounts. This suspicion was justified. It was the temporary, some say permanent, diversion of the immense sums of Williams money which enabled Nathan to launch his banking operations, providing him with both liquidity and prestige.

William continued to release further large sums. Then, in 1811, Kalmann Rothschild smuggled himself in and out of England to present the Prince with his first consol certificates for 189,000 pounds. William was relieved. But he had enough of stress, and wrote to Buderus: “I am getting sick of my investments- – I would prefer to keep my money lying idle.”

In 1811, William’s decision no longer bothered the Rothschilds. Another milestone had been turned. Nathan’s wealth, at the young age of 34, mushroomed explosively. It grew so huge that even William, Europe’s richest man, became too small to be the chief account in the Rothschild book. William was just the beginning. Something much bigger had to be found. We now proceed to the next phase.

Stepping Stone 2 Napoleon Bonaparte-Emperor of France

Nathan once reminisced: “The East India Company had 800, 00 pounds of gold to sell. I went to the sale and bought it all. I knew the Duke of Wellington must have it; they sold the gold to me and did not know how to get it to the Duke in Portugal. I undertook all that, and sent it to France. It was the best business I had ever done.”

This sums up rather gruffly an enormous, incredible cunning operation. Basic to this is the fact that Napoleon played hand-maiden to the family once again. In 1807, he had produced for them a goods shortage in the Continent. In 1810, he brought about a poor investment climate. Now, he obliged them with an exquisitely placed front-line. Napoleon’s army was fighting Britain’s Wellington behind the Pyrenees Mountains in Spain, far from British supply lines.

To feed his army, the Duke had to issue bank drafts on the English treasury. A whole mob of Sicilian and Maltese financiers cashed these at deep discounts, and sent these drafts along a convoluted route to London for cashing. Sporadically, Nathan took part in some of these, but until 1811, this had been a sideshow.

There was only one route Nathan could use to send these 800,000 pounds of gold to Wellington- and that was through the very France that England was fighting. Of course, the Rothschild blockade-running machine already had superb cogs whirring all over Europe, including southern France and Spain. What many bankers were doing, Nathan and his brothers wanted to do it alone. He would move English hard money into Spain. Nathan became the chief broker and paymaster to England’s most important army.

As the fortunes of war swung back and forth, so did stock and commodity prices. In this situation, fortunes are lost and made. The price of gold in London was high, and restrictions on its exports boosted its value. Nathan found a way to move gold to the Continent, and vice versa, without depressing the price, once its sale took place. All profits from manipulating the gold price went towards moving the government’s hard money to Wellington. All of this required three things: information, secrecy, and cunning.

On March 24, 1811, Jacob- now called James, the youngest son, arrived in Paris, and registered with the police. James was helped by the Grand Duke Delberg, a high Napoleonic official who had just been given a favorable loan. James did not know Paris and he could only speak German and Yiddish. Two days after his arrival, a report by the French Finance Minister to Napoleon read, in part “a Frankfurter named Rothschild is now staying in Paris, and is occupied in bringing British gold from the English coast to Dunkirk. He states that he has just received letters from London, according to which the English intend to stop this export of gold.”

This was deception on a grand scale-nothing new for a Rothschild. The French were happy with news like the above as they regarded this run on English gold as proof that Britain was on the verge of economic collapse, and that her trading partners were rushing to get their capital out before the crash. That was wishful thinking. Britain received more gold from America and her colonies, than what was going out. Britain needed to export gold to pay for the armies fighting Napoleon. Nathan and James worked closely with J.C. Herries, the supply quartermaster for the British.

So Nathan sent the gold across the Channel to Dunkirk. James received it, and paid for it will bills drawn on London banks. Next Nathan and James obtained bills drawn on the Paris banks holding the gold. These bills were conveyed to Wellington by courier for presentation to Spanish banks. The amount raised for the war effort in London in 1811 was 23 million pounds. In 1812, this was increased to 33 million pounds. Most of this was handled by the Rothschilds. As James was the pivotal point for so many negotiations, the pressure on him was enormous. It was a baptism by fire.

In Spain, French troops were driven out. In 1812, Napoleon was preparing to invade Russia. Of the 612,000 soldiers who entered Russia in June 1812, only 110,000 returned in December. Napoleon was defeated by the Russians. Napoleons disastrous retreat from Russia put heart into his enemies. Supported once more by British funds, Austria and Prussia joined forces with Russia and defeated Napoleon in October 1813. Napoleon was exiled to the island of St Helena. Within weeks, the exiled princes, including William returned to their capitals.

By now Nathan and his brothers had given ample proof of their discretion and ability to move large sums of money efficiently around the Continent. The ravaged economies of the Continent set about rebuilding. And loans were needed for this. The Rothschild banks in Frankfurt, London and Paris had now accumulated massive fortunes, and had established between them a unique clearing house for international bills of exchange.- the first time ever in the world.

But if the Rothschilds imagined that new business would come pouring in from grateful governments, they reckoned without human nature. Everything Napoleon had stood for was to be buried and forgotten, and that included Jewish emancipation. In Europe, a violent reaction against Jewish financial influence started. The nobility, who had courted Mayer in the dark days of Napoleon’s rule, had now shunned his sons. Jealous bankers were determined to oust them from the major markets. The result of all this was that the brothers had to fight hard for every major piece of business. To the brothers, this was not right. Something had to be done.

Napoleon was originally put in power by Jewish finance, and also toppled by them. Evidently, his usefulness to them was not yet over. They broke him out of the British prison, and brought him back to France on March 2, 1815 as they needed him for one more job. Napoleon marched north, rapidly gathering support from thousands of Frenchmen, who resented the imposition of a King sponsored by the British. The masses in France were overjoyed to see their hero back. Thousands of soldiers flocked to his side, and he soon gained control of the country. Napoleon then built up another massive army.

This new crisis gave Nathan the opportunity to establish his financial supremacy beyond any doubt. The Herriers-Rothschild machine went, once more, into high gear. Again, there were armies to be financed. The Rothschilds handled all the funding of this coming war. In mid-June 1815, all of Europe awaited the outcome of what was expected to be the climax of a war that had been raging for 25 years. Napoleon lost the battle at a place called Waterloo.

In London, Nathan had received the information much earlier than the government – due to the superb intelligence network that the brothers had built up over the past 20 years. Nathan went to the London Stock Exchange, and with a gloomy face, began selling shares and bonds. As he was a serious player, many thought he was selling because Napoleon had won. If that was the case, then the British financial and economic system would crash. So, they followed Nathan, and also began selling. Prices reached rock-bottom. And then, Nathan began buying, and kept on buying until the real news finally reached the government and financial markets in London. The markets boomed. Nathan made a killing.

These then, were the two acts, or stepping stones, in the establishment of the Rothschild fortune during the closing years of the Napoleonic Wars.

The Founder Dies

In September 1812, Old Mayer passed away. Before he died, he dictated a will, which placed his business exclusively in his sons’ hands. Basically, it contained the stipulation that his heirs must remain true to the Jewish faith, no public inventory must be made of the estate, and the eldest son of the eldest son to be the head of the family and the ruler of the fortune. This established a permanent family partnership, and one sees that there have been no published reports on any of the privately owned Rothschild enterprises. The effect of this will created a kingdom- not only for the Rothschild family, but for all the Jews in the world. Wherever a Jew is located, whatever nationality he may claim, he is a subject of this kingdom; his allegiance and duty to it supersedes that to the country in which he dwells.

Congress of Aachen

The Rothschilds emerged from the war as millionaires and celebrities. The close connection between governments and the Jewish bankers attracted unfavorable comment. Anonymity was impossible for Nathan who played a very prominent part in the overthrow of Napoleon, and in the process becoming England’s richest citizen. The brothers were marked men and attracted resentments of all kind. This made them cautious about displaying their wealth.

Their position within Jewry had changed dramatically. As the richest and most famous Jews in the world, they had assumed a symbolic role as representatives of their race. Cultivated by prospective clients, despised by others and hated by the majority, the Rothschilds were not deceived by the ambivalence of their position.

The family’s first major coup was made in Austria. The extensive Austrian Empire was desperately in need of funds. Metternich, the Chancellor, was determined to put order to the state’s finances- and he needed the Rothschilds for this. In class-ridden 19th Century Europe, titles were important. They were proof of royal patronage and the passport to bigger and better business opportunities, and the brothers itched to acquire them. As a bribe, the Austrian Finance Minister raised the 4 brothers to the ranks of nobility, and made Nathan the Austrian Ambassador.

Between 1816 and 1818, the brothers took stock of their business. Now that they were no longer dominated by the need for frantic haste and total secrecy, affairs could be placed on a regular footing, which distributed profits equitably and allowed all the partners to be kept fully aware of what each was doing. In 1816, the Paris bank was re-founded as Rothschild Freres. The 3 houses remained quite distinct business entities. It was this flexible interdependence which was to prove so powerful in all the commercial challenges of the 19th century. Nathan’s leadership was now formally recognized. His brothers realized that all their prosperity was due to his energy and vision. It was also recognized that Britain was the world’s leading power for now and the foreseeable future. The family’s plan would be greatly advanced by basing their most important branch in London.

In September 1818, the leaders of Europe met at Aachen to discuss the floating of a loan designed to help the French government pay off its war liabilities. The Rothschilds had not been involved in the first loan, but were hoping to get a share of the second loan, which was to be discussed.

The main bankers of the first loan were Christian bankers from London, Paris and Amsterdam. They had seen the value of their first French loan rise dramatically, and were determined to that they would take up the lion’s share of the second loan. These bankers were determined to keep the Rothschilds out.

Salomon and Carl hastened to Aachen to argue their case. At social functions they were ill at ease. The other bankers refused to meet them. Salomon and Carl dispatched couriers to their 3 brothers, and within days the powerful Rothschild financial machine was in motion. Throughout October, the 2 brothers were ignored and shunned, socially and in business discussions.

On November 5 a strange thing happened. The bond price of the first French loan, after a sharp rise, was falling on the exchanges. Day after day they dropped more steadily, and not only that, other securities also wavered. There seemed to be no rhyme or reason for this dramatic downturn in the market. The bankers met in urgent conclave. The music stopped. Gradually the truth emerged. It was the Christian bankers and nobility who were now frowning, while, curiously, Salomon and Carl were smiling.

The Rothschilds and their agents had bought up every parcel of loan stock that came on the market. As the price rose, more investors sold, and the Rothschilds bought. Then, at a prearranged time, they dumped all their shares, simultaneously. It was an unprecedented display of financial muscle and it had the desired effect. The other bankers were obliged to allow the Rothschilds a share of the second loan. As the music began again, everyone knew what had happened. The dress and clothes of the Rothschilds was now the very eye of fashion, their money the darling of the best borrowers. Europe had become richer by a great new power. The boys had become the Rothschilds.

In terms of family history, the forgotten Congress at Aachen is a much more important landmark than the still notorious scoop of Waterloo. After this Congress no one could seriously doubt the Rothschild’s financial supremacy, especially those representing the Austrian Emperor. These close ties with the Austrian Empire and the negotiation of an enormous new loan involved Salomon in frequent visits to Austria. Salomon bought the leading hotel and turned it into his office and residence. At this ex-hotel Salomon ingratiated himself with the Austrian nobility by inviting its luminaries to dinners and banquets which rapidly became the talk of the town.

Austrian Chancellor Metternich was delighted that Salomon had settled in Vienna. The banker was a wise and shrewd adviser on matters of economic policy; he gave the Austrian government access to the incomparable Rothschild information and intelligence network. He was always on hand to negotiate funds for the imperial coffers and for its client states. Within the family, the Imperial Chancellor was known as “uncle” Metternich. The creation of a close bond between Salomon and Europe’s most powerful leader in Europe was a coup for the family. Metternich was the arbiter of Europe. His pledge to stability and maintenance of the internal order suited the Rothschilds well during a period when they were consolidating their position as state financiers, and expanding into industrial markets. Metternich’s patronage brought them not only immense prestige and new business opportunities; it gave them a means of influencing policy in ways favorable to commercial expansion. The family developed a taste for COVERT POLITICAL INFLUENCE. Further honors were thrown their way. In September 1822, all 5 brothers and their male descendants were raised to the rank of Baron.

The story continues in Part 2 – the next issue.

One thought on “The Rise of the House of Rothschild Part 1 (of a 6 Part Series): 1744 – 1810”