Following the 2008 financial crash, the Federal Reserve lowered interest rates to nearly zero. Banks then lent this money to favored clients, who then used this “free money” to speculate on the stock and commodity markets, earning a higher returns than what they were borrowing. Their hope was that these profits would go a long way to filling in the hole in their balance sheets.

Following the August 2019 Repo crisis on Wall Street, the Rockefeller Empire decided to shut down the global economy in order that demand from the private sector be reduced. All of this was done to save the collapsing financial empires of the 2 families, and the western banking system. This move bought some time for the 2 families, and by March of 2021, it was clear that things would worsen over the course of the next two years. At this point, the go-ahead was given to launch the project the “break-up and dismemberment” of Russia. This was done for geo-economic and geopolitical reasons.

Let me explain. Firstly, were this plan to succeed, then NATO would be in a pole position to control the future trajectories of China and Iran. Russia supplies energy to China. Remember Kissinger’s 1970’s dictum, that “whoever controls the flows of oil, controls the destinies of nations”. A NATO-controlled Russia would leave Iran in an extremely vulnerable position, in terms of regional security and energy supplies to China. Control over Iran would give the 2 families great leverage in creating conflicts between Iran and the Arab world.

Secondly, due to Russia’s low debt, very abundant natural resources, it would be the ideal “bank” to rob, in order to save its financial system. Bring down Russia, and be in a position to control Eurasia. These factors propelled NATO to start the war in Eastern Ukraine on February 17th, 2022. It began with the incessant shelling of the Donbass. A week later, Putin counter-attacked. We know the rest.

The West initiated financial and economic sanctions on Russia. Putin went on the offensive, and issued two announcements.

On 22 March, exactly one month after Putin’s counter attack began; Putin announced that all oil sales will be sold to “unfriendly” countries IN RUBLES. Then a week later, Putin announced that the ruble will be backed by gold. These two announcements hit the Rockefeller Empire like a nuclear bomb. If this policy of Russia was not reversed, it would mean the end of the dollar (backed by nothing). Following the Western seizure of Russian gold and dollars within the western banking system, a process of de-dollarization began. These 3 moves, combined to form a perfect storm for the dollar system. It was a declaration of war from Putin against the 2 families and their entire Western-based economic and financial edifice of control. From this moment on, there could only be one winner left standing. Either the 2 families win, or Putin wins. It is a zero sum game. In short, this war has become an existential war- for both parties.

Over the next few months, the use of dollars began to decrease in international trade. Add to this the U-turn by foreign investors into the dollar system. Now, they were moving out of the dollar. All those “unwanted “dollars are returning home. To add insult to injury, the longer the Ukraine war went on, the more the battlefield conditions and results favored Russia, while the NATO combine was suffering loss after loss. The greater the loss in Ukraine, the faster the rush to the exits for dollar holders. This flood of dollars back into the US economy has unleashed inflation- i.e.; more money chasing less goods. As de-dollarization accelerates, more unwanted dollars floods back into the US economy- stroking up inflation. This process will not stop, but increase in velocity and volume.

To counter this inflation, the Fed began raising interest rates from April 2022. Rates went from nearly zero to 5 % today. On this point, we should make a note. Raising interest rates is the wrong answer to this by the Fed. It’s like going to a dentist for a toothache, and he cuts your nose off. There is absolutely no cure for this problem- a problem that’s beyond salvage. And with rising yields, bond prices fall as the bankers at Silicon Valley Bank discovered to their cost.

US Treasury yields are not alone. All the Eurozone bonds, UK gilts, and Japanese government bonds exhibit the same frightening condition. The Bank of Japan’s determination to keep interest rates and bond yields in negative territory undermined the yen’s exchange rate by as much as 30%. Now that it appears to be losing control over bond yields, the yen carry trade is reversing. And the extent to which Japanese banks and investment funds along with international investors have borrowed and sold yen to invest in higher yielding bonds in other currencies, these flows are reversing to the benefit of the yen cross rate and the detriment of foreign bond markets. Japan is beginning to dump dollars and bring that money back home. It’s less about economics and more about faith in fiat. Fiat currency is inherently unstable. It is entirely dependent in the oft quoted phrase about the dollar’s value being based on the “full faith and credit in the government as its issuer”. Taken literally, economics and monetary policy are secondary factors in a fiat currency’s valuation — lose faith in the issuer and the currency is doomed irrespective of economics.

But the world is now tired of faith and credit in a weaponised dollar, and therefore of all the currencies which tag along with it. Other than the arrogance of weaponization of the fiat dollar, the trigger for a collapse in the faith and credit in the fiat dollar is the US Government’s policy of banning fossil fuels. The strategic wisdom of President Nixon and Henry Kissinger to tie the dollar’s future to energy demand has been undone in a stroke. The entire Gulf Cooperation Council, led by the Saudis, has now abandoned the 1973 agreement. The link is gone, and with it the dollar’s future security.

Inevitably, politicians in undeveloped economies around the world with safety in numbers now feel freed from the dollar’s tyranny. This is why they seek better international relationships with the Russian and Chinese axis. It coincides with a new realism in Africa and elsewhere that the days of politicians lining their pockets with western aid programmes are over. Instead, genuine investment in infrastructure is the way forward and that is what China is already providing. America could ill-afford to see international investment capital be diverted from America to other destinations. And today, the US Treasury is feeling this pressure with foreign investment in its debt stalling at a time when they are most needed, and threatening to turn into net selling. Economic conditions are additional to geopolitical developments.

The Great Unwind Begins

This brings us back to the headline chart of the 10-year US Treasury note. Yields are bound to go higher if foreigners start selling down their massive $7.5 trillion position in US Treasuries at a time when the US Government’s borrowing requirements is rising strongly.

The West’s global banking system fundamentally changed in the mid-eighties from financing Main Street to financing an asset boom on Wall Street. Europe followed, facilitated by Big-Bang in London. Large-scale manufacturing emigrated to Asia, where labor was cheap, available, intelligent, and lacked attitude. Factories could be up and running in very little time, compared with the planning and other regulations which led to long lead times in America and Europe. Instead of providing liquidity to businesses which had migrated overseas, the big banks invested heavily in financial activities. It is that trend which is now unwinding.

The expansion into financial activities was the origin of the London bullion market massive expansion, which grew rapidly on the back of a carry trade, borrowing and selling leased gold to invest in higher-yielding Treasuries. Regulated derivative markets rapidly expanded from their agricultural roots, and over-the-counter derivatives mushroomed. According to the Bank for International Settlements, the notional value of OTC derivatives currently is $618 trillion and open interest in regulated derivatives are a further $38 trillion. The large majority are dollar contracts, so the dollar is bound to be in the firing line of the Great Unwind. Furthermore, many of these derivatives are credit obligations for notional amounts not reflected on bank balance sheets, which only record their mark-to-market value. The exposure of banks is considerably worse than their balance sheets suggest.

It seems inevitable that a combination of a declining dollar and higher interest rates will lead to a substantial reduction in the size of these markets, and financial accidents in the form of counterparty failures are likely to become a feature. It comes at a time when bank balance sheets are highly leveraged and are at the top of the bank credit cycle. Recognising the dangers, bankers in North America and Europe as a cohort are increasingly cautious, seeking every opportunity to reduce their risk exposure. Already, bank lending in major jurisdictions is contracting. A general shortage of credit arises, which threatens to plunge the entire economy into a slump.

The fiat currency regime which has lasted since 1971 is now coming to an end. Replacing it will be currencies exchangeable for real values, be they energy or commodity based. And always correlating with a basket of these commodities is gold.

The End of Full Faith, Credit of the Dollar and the Return to Gold

For decades, China and Russia between them have looked forward to trade between members, dialog partners and associates of the Shanghai Cooperation Organisation being settled in a currency medium other than the dollar. They fully recognised the unwelcome control that the dollar, its organisations (World Bank, IMF etc.), and America’s banking system exercises over their own spheres of influence in Asia and beyond. Getting rid of the dollar had been an evolutionary process until the western sanctions against Russia and its theft of Russia’s foreign reserves March last year.

Putin also prepared the ground for a new settlement currency, bringing in any nation seeking to protect themselves from dollar hegemony. Originally billed as a settlement currency for cross-border trade and commodity purchases between members of the Eurasian Economic Union, it also appears to be the basis for a new trade settlement medium for the BRICS members.

The Gold Factor

Priced in gold, the price of a barrel of oil is remarkably stable, the volatility being in the dollar and other fiat currencies. The myth that rising interest rates for fiat currencies is detrimental for the gold price has its origin in the carry trade of the 1980s, when it was possible to lease gold from a central bank at less than one per cent, sell it into the market and invest in US Treasury bills yielding six per cent. Returns were even greater when this carry trade was leveraged up. Ever since then, traders have automatically assumed that higher dollar interest rates would lead to selling gold and buying dollars.

Fifty years of official suppression of the gold price. As I have written before, after extensive and careful research, analyst Frank Veneroso concluded as long ago as 2002 that between 10,000 and 14,000 tons of central bank gold were either leased or swapped. And he further concluded that much of that gold “was adorning Asian women” so would not be returned.

We know that the Bank of England arranges these contracts for its central bank clients. We can only assume that the New York Fed similarly arranges these income generating activities on behalf of earmarked gold in its custody. Worse still is the thought that the New York Fed might have sold off earmarked gold into the markets, which would explain why it refused to let Bundesbank representatives inspect its gold, and initially proved extremely reluctant to return only 300 tons out of 1,536 tons of Germany’s gold supposedly held in the New York vault. And presumably, it was the Bundesbank’s experience which prompted the Dutch Central Bank to repatriate 122 tons of its gold from New York, leaving 190 tons behind at the New York Fed. Similarly, the Rothschild’s Bank of England refused to return Venezuela’s gold. Likewise, around 2012, when the Fed repatriated a part of China’s gold back to Shanghai. On inspection, it was found to be tungsten bars coated with gold!

With the failing of the fiat currency regime, the chickens of gold leasing and price suppression are now coming home to roost. It is becoming apparent that at a minimum the stagflationary conditions of the 1970s are returning, when gold rose from the official rate of $35 per ounce to over $800. And the Fed funds rate rose from about 6% to nearly 20%. After fifty-two years of currency debasement, the starting point for a new rise in the gold price is somewhere between $1500—$2000. And arguably, the dollar is in a far worse position today than it was when President Nixon suspended the Bretton Woods Agreement.

The Global Bank Credit Crises

The contraction of bank credit is in its early stages, and that alone will push up interest costs for borrowers. We have an old fashioned credit crunch on our hands. A new bout of price inflation, which more accurately is an acceleration of falling purchasing power for currencies, also leads to higher interest rates. Savage bear markets in financial and property values are bound to ensue, driving foreign investors to repatriate their funds. This will unwind much of the $32 trillion of foreign investment in the fiat dollar which has accumulated in the last fifty-two years. And BRICS’s deliberations for replacing the dollar as a trade settlement medium could not come at a worse time. Global banking risks are increasing. A global cyclical downturn in bank credit is long overdue, and that is what we currently face.

Credit, which is synonymous with the towering mountains of debt is all about faith: faith in monetary policy, faith in the currency, and faith in a counterparty’s ability to deliver. Before we look at risks faced by the fiat currency cohort, it is worth listing some of the factors that can lead to the collapse of a credit system:

Contracting bank credit: Contracting bank credit is the consequence of the bankers recognising that lending risks are escalating. It is an acute problem when bank balance sheet leverage is high, magnifying the potential wipe-out of shareholders’ capital arising from bad and doubtful debts. Consequently, both normal and over-indebted borrowers whose cash flow has been hit by higher interest rates are denied loan facilities, or at the least they are rationed at a higher interest cost. Therefore, the early stages of a credit downturn see interest rates rising even further leading to business failures. Essentially, the central banks lost control over interest rates. Today, 40% of the companies of the S&P 500 are known as “zombie companies” They are able to survive due to near zero interest rates. In the past 20 months, rates have shot up to 5 %, with the chances are that it will increase even more. These zombie companies will then become “dead” companies.

Interbank counterparty risks: There is a long history of banks suspecting that one or more of their number has become overextended or mismanaged and is therefore a counterparty risk. Banks have analytical models in common to determine these risks, so there is a danger that the majority of banks will share the same opinion on a particular bank at the same time, leading to it being shut out of wholesale markets. When that happens, it cannot fund deposit outflows, is forced to turn to the central bank for support, or it suddenly collapses. Recently, this was the fate of Silicon Valley Bank. A downgrade by a credit agency, such as S&P or Fitch, could trigger an interbank lending crisis, either at a local or international level in the case of a country downgrade. These downgrades have now started.

Rising bond yields: Banks usually stock up on government debt, redeploying their assets when they are cautious about lending to the private sector. Again, Silicon Valley Bank serves as an example of how this can go horribly wrong. It was able to fund bond purchases at close to zero per cent to buy Treasury and agency debt of longer maturities to enhance the credit spread. When interest rates began to rise, the bank’s profit and loss account took a hit, and at the same time, the market values of their bond investments fell substantially, wiping out its balance sheet equity. Quantitative tightening. Collectively, the major central banks (the Fed, ECB, BoJ, and PBOC) have reduced their balance sheets by some $5 trillion since early-2022. This QT has been put into effect by not reinvesting the proceeds of maturing government debt.

An even greater danger is lurking just below the surface for financial institutions in the US. Insurance companies, hedge funds and banks are currently sitting with a loss on its bonds are around $1 trillion!! These losses have been building up over the past 20 months. The banks are hiding these losses, but for how long can they do that. Most likely, either at the end of December 2023, or March 2024, these losses will begin to be reflected on the P & L results. At this point, many banks will go bankrupt.

Collateral liquidation: All the charts of national bond yields scream at us that they are continuing to rise, instead of stabilising and eventually going lower . Furthermore, with oil and other energy prices now rising strongly, the prospect of yet higher interest rates driven by contracting bank credit (as detailed above) along with a number of other factors discussed in this article point to significantly higher bond yields driving a bear market in financial assets and property values. Where banks hold collateral against loans, there will be increasing pressure on them to sell down financial assets before their values fall further, or worse, increasing margin calls to such clients. Many of these clients are themselves highly leveraged, leading to fire-sales of assets in order to meet such margin calls. A race to liquidity is raging.

Derivatives: Derivative liabilities come from global regulated markets, which are assessed by the Bank for International Settlements to have an open interest of about $38 trillion last March with a further $60 trillion notional exposure in options. Markets in unregulated over-the-counter(OTC) derivatives are far larger, at an estimated $625 trillion at end-2022 comprised of foreign exchange contracts ($107.6 trillion) interest rate contracts ($491 trillion) equity linked ($7 trillion), commodities ($2.3 trillion), and credit including default swaps ($9.94). All derivatives have chains of counterparty risk. We saw how a simple position in US Treasuries undermined Silicon Valley Bank: a failure in the derivative markets would have far wider consequences, particularly with regulators being unaware of the true risk position in OTC derivatives because they are not in their regulatory brief. Losses in the derivatives market are of the order in greater magnitude than anything witnessed to date in the history of finance.

Repo markets: In all banking systems, some more than others, banks depend on repurchase agreements to ensure their liquidity. Even though repos are collateralised, the consequences of a counterparty failure are likely to be far more concerning to the stability of the banking sector as a whole. And with higher interest rates, falling collateral values seems set to dry up this liquidity pool.

Looking at all these potential areas for systemic failure, it is remarkable that the sharp rise in interest rates so far has not triggered a wider banking crisis. The failures of Credit Suisse and a few regional banks in the US are probably just a warm-up before the main event. But when that time arrives, it becomes an open question as to whether central banks and their governments’ treasury ministries will pursue bail-in procedures mandated in G20 members’ laws in a knee-jerk response to the Lehman crisis. Or will they resort to bailouts as demanded by practicalities? Lack of coordination on this issue between G20 nations could jeopardise all banking rescue attempts.

As the reserve currency for the entire global fiat currency system, the dollar and all bank credit based upon it is likely to be the epicentre of a global banking crisis. If other currencies weaken or fail, there is likely to be a temporary capital flight towards the dollar before financial contagion takes over. But if the dollar fails first, all the rest fail as well.

The condition of the US banking system is therefore fundamental to the global economy. There are now signs that not only is US bank credit no longer growing but is contracting as well.

Foreign investors are rushing for the exit: A second weak point is the US’s dependency on foreign dollar short-term holdings. As dollar bond yields rise, undermining the capital values of the $32 trillion of foreign-owned financial assets and bank deposits, foreigners are bound to sell their dollar assets to avoid mounting losses. And already, we see many foreign nations which are not allied with America beginning to take evasive action; it is clear that the fiat dollar regime has almost run its course. The withdrawal of credit from the US economy will undermine the currency, increase the rates of US producer and consumer price inflation, and therefore drive up bond yields. Financial asset and property values which have become dependent on cheap finance will take a massive hit, serving to encourage additional foreign selling of non-financial assets. The losses for banks, not just in the US, are set to rapidly escalate.

The inflationary consequences are one thing, but the impact of rising interest rates due to the dollar being sold down by foreign investors will intensify the debt trap by rapidly increasing debt funding costs.

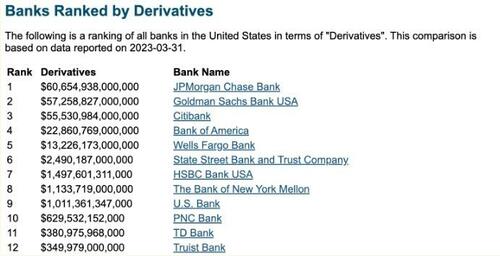

As if this is not enough, at the same time the collapse of bank credit is bound to act negatively on derivative obligations. The table below is a snapshot of OTC obligations for the top twelve US banks.

For the reader losing count of all the noughts, it should be noted that for the top nine their exposure is in the trillions- or $200 trillion for these 12 banks.

For example, in the BIS derivative estimates, the notional value of foreign exchange OTC contracts last December was $107 trillion with a gross market value of $4.846 trillion – the US dollar is a component of 88.5% of this FX position. All dollar contracts have US banks as counterparties. This gives rise to two systemic threats. The first and most obvious is counterparty failure with a foreign bank or shadow bank. Obviously, with rising interest rates and collapsing financial asset values in collateral, the risk of counterparty failure from outside the US banking system will increase. The second counterparty failure comes from contracts between two US banks or shadow banks. And even that is unlikely to be enough. The great unwind of the last fifty-two years of pure fiat dollars will surely threaten not only the dollar’s existence, but its highly leveraged banking system.

The discarding of the fiat currency past for a currency or currencies more closely allied to energy and commodities, which is actually what gold represents, is not limited to the destruction of fiat dollars, but of all other fiat currencies as well. For our current purposes, what also concerns us is the same threat faced by the other major currencies: the euro, yen, and sterling.

It has already been mentioned that an initial failure in the US banking system will be the likely course of events because it is the most over-owned of all the major fiat currencies. But if a banking crisis does break out elsewhere first, it could lead to the dollar being temporarily bought as a safe haven until financial contagion undermines all banking relationships

For Eurozone government bonds, over the last year the losses in bond values in the euro system amount to about €700 billion. This is nearly six times the combined euro system’s equity. The valuation problem is concealed by euro system accounting, which values bonds on a straight line basis between purchase price and final redemption value. Yet, Europeans rely upon the euro system to backstop the entire commercial banking network, whose global systemically important banks (GSIBs) are even more leveraged than the American banks. The €10 trillion repo market also faces collapsing collateral values. Eurozone GSIBs have heavy exposure to derivative counterparty risks. Yet, the euro system itself is bankrupt, having paid top euros for bonds which have been sinking faster than a tropical sun at twilight.

It is in the nature of a banking crisis that several factors come together in an unexpected perfect storm. We will all be wise after the event. But for now, we can only observe the disparate strands likely to come together and destroy the euro system, its commercial banks, and possibly the euro itself. That is the wet dream of the Rockefeller Empire. (Ever since the French Rothschilds (in Sept 2000) persuaded Saddam Hussein of Iraq to sell its oil for euros, and not the dollar. It took 3 years for the US to overthrow Saddam Hussein and bring Iraq back into the dollar orbit. The 2008 financial crisis was meant to start the destruction of the Euro. Remember, the family motto is “Competition is a Sin !”) That is, if the US banking system doesn’t collapse first.

My conclusion is that the era of the fiat dollar based global currency system is rapidly ending, and for America and the dollar there can be no Plan B. It will almost certainly lead to the end of the fiat dollar, and the end of the US hegemony.

To summarise the evidence, foreigners own or are exposed to a massive $137 trillion dollars. As a cohort, if they decide to begin reducing their exposure US residents have less than a trillion equivalent in foreign currencies to sell in exchange. In the jargon of the markets, the dollar will become “offered only”. There will be no buyers for the dollar! This is the true danger from rising interest rates. As they rise, the declining value of foreign-owned long-term securities totalling $37 trillion will simply accelerate generating widespread investment and dollar liquidation. This will not be offset by US holders of foreign investments liquidating their positions for a simple reason.

The Looming Quadrillion Dollar Derivatives Tsunami

But first a look at the derivatives problem and how it got out of hand.

A “financial derivative” is defined as “a security whose value depends on, or is derived from, an underlying asset or assets. The derivative represents a contract between two or more parties and its price fluctuates according to the value of the asset from which it is derived.”

Warren Buffett famously described derivatives as “weapons of financial mass destruction,” but they did not start out that way. Initially they were a form of insurance for farmers to guarantee the price of their forthcoming crops. In a typical futures contract, the miller would pay a fixed price for wheat not yet harvested. The miller assumed the risk that the crops would fail or market prices would fall, while the farmer assumed the risk that prices would rise, limiting his potential profit. In either case, the farmer actually delivered the product, or so much of it as he produced. The derivatives market exploded when speculators were allowed to bet on the rise or fall of prices, exchange rates, interest rates and other “underlying assets” without actually owning or delivering the “underlying.” Like at a race track, bets could be placed without owning the horse, so there was no limit to the potential number of bets. Speculators could “hedge their bets” by selling short — borrowing and selling stock or other assets they did not actually own. It was a form of counterfeiting that not only diluted the value of the “real” stock but drove down the stock’s price, in many cases driving the company into bankruptcy, so that the short sellers did not have to cover or “deliver” at all (called “naked shorting”).

The derivatives bubble is often estimated to exceed one quadrillion dollars (a quadrillion is 1,000 trillion). The entire GDP of the world is estimated at $105 trillion, or 10% of one quadrillion; and the collective wealth of the world is an estimated $360 trillion. Clearly, there is not enough collateral anywhere to satisfy the entire derivative claims. The majority of derivatives now involve interest rate swaps, and interest rates have shot up. The bubble looks ready to pop.

Enter the DTC, the DTCC and Cede & Co.

Who were the intrepid counterparties signing up to take the other side of these risky derivative bets? Initially, it seems, they were banks – led by four mega-banks, JP Morgan Chase, Citibank, Goldman Sachs and Bank of America. The counterparty risk on all of these bets is ultimately assumed by an entity called the Depository Trust & Clearing Corporation (DTCC), through its nominee Cede & Co which is now the owner of record of all of our stocks, bonds, digitized securities, mortgages, and more; and it is seriously under-capitalized, holding capital of only $3.5 billion, clearly not enough to satisfy all the potential derivative claims.

What happens if the DTCC goes bankrupt? Derivatives have “super-priority” in bankruptcy. Derivative claimants don’t even need to go through the bankruptcy court but can simply nab the collateral from the bankrupt estate, leaving nothing for the other secured creditors or the banks’ unsecured creditors (including us, the depositors). And in this case the “bankrupt estate” – the holdings of the DTCC/Cede & Co. – includes all of our stocks, bonds, digitized securities, mortgages, and more.

It is about the taking of collateral (all of it), the end game of the current globally synchronous debt accumulation super cycle. This scheme is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass. Included are all financial assets and bank deposits, all stocks and bonds; and hence, all underlying property of all public corporations, including all inventories, plant and equipment; land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will likewise be taken, as will the assets of privately owned businesses which have been financed with debt. If even partially successful, this will be the greatest conquest and subjugation in world history.

In exchange-traded derivatives, a third party, called a clearinghouse, ensures that the bets are paid, a role played initially by the bank. And here’s where the DTCC come in. The bank takes title in “street name” and pools it with other “fungible” shares. Under the DTCC, the purchaser of the stock does not hold title; he has only a “security entitlement”, making him an unsecured creditor. He has a contractual claim to a portion of a pool of shares held in street name, assuming there are any shares left after the secured creditors have swept in.

Furthermore, collateral values backing these derivatives and other leveraged commitments have fallen sharply, adding to enormous and escalating amounts of collateral top-ups being required, aka “margin calls”. And this is occurring at a time when bank credit is tightening, which is bound to lead to higher market rates for bond yields anyway, even without collateral demand from interest rate swaps being unwound.

This is rapidly turning into a doom-loop, similar to that exposed by the UK’s March 2022 crisis, but involving the dollar, the euro, and all other major currencies. Additionally, US banks are probably heading towards a trillion dollars in mark to market losses on their bond positions, and as borrowing costs continue to rise the damage to their P&L accounts funding their bond holdings is increasing.

Perhaps this persuaded the Fed to go easy on interest rate policy, the FOMC having put it on pause last month. If so, it didn’t work, because US Treasury note yields rose sharply in the wake of the last FOMC statement. And then there is the commercial real estate crisis in America, to which regional banks are particularly exposed. This is a situation which is already out of control, with escalating collateral demand forcing liquidation of bonds, driving borrowing costs and bond yields inexorably higher. It is becoming rapidly apparent to lenders that collateral values are likely to continue to fall, particularly for longer durations, and that leverage is the road to disaster.

Currently, bond yields are rising strongly, which means that collateral values are falling. It amounts to a credit contraction of up to 40% on longer dated bonds so far. And where collateral backs leveraged interest rate swap positions, calls can be catastrophic. This takes us back to the enormous mountain of dollar credit in foreign hands. Long term investments, totalling $26.1 trillion, plus a further $10.7 trillion in Eurobonds will all fall in value as interest rates continue to rise. There can be no doubt that foreigners will sell these positions down. Their only problem is what to do with cash dollars, which already amount to over $100 trillion. Other currencies are mostly less attractive than the dollar. There is only one thing to be done, and that is to follow the Singaporeans, who have the prescience to accumulate hard real money without counterparty risk, which is physical gold.

And finally, there are geopolitical considerations. The deteriorating collateral position is surely being observed with concern in Asia and the Global South. The sudden rise in US Treasury bond yields is signalling that a global debacle is already developing, in which case the collapse of financial market values could escalate rapidly from here. And if Russia, perhaps followed by China decides to deploy their gold reserves in order to secure the value of their currencies, it is bound to be the coup de grace for the fiat currency system.

Now that we understand the biggest story no one wants to talk about, the rest of whatever comes up in the world of geopolitics and the shift to a multipolar world, will be much more clearly understood.

Our next article covers this topic. Till then, hang tight.